by | ARTICLES, BLOG, FREEDOM, GOVERNMENT

I could post something from the eloquent Thomas Jefferson, but I’ve always loved this quote from Winston Churchill:

“We must never cease to proclaim in fearless tones the great principles of freedom and the rights of man which are the joint inheritance of the English-speaking world and which through Magna Carta, the Bill of Rights, habeas corpus, trial by jury, and the English common law find their most famous expression in the American Declaration of Independence”

— Winston Churchill in Fulton, Missouri, 5 March 1946.

by | BLOG

by | BLOG

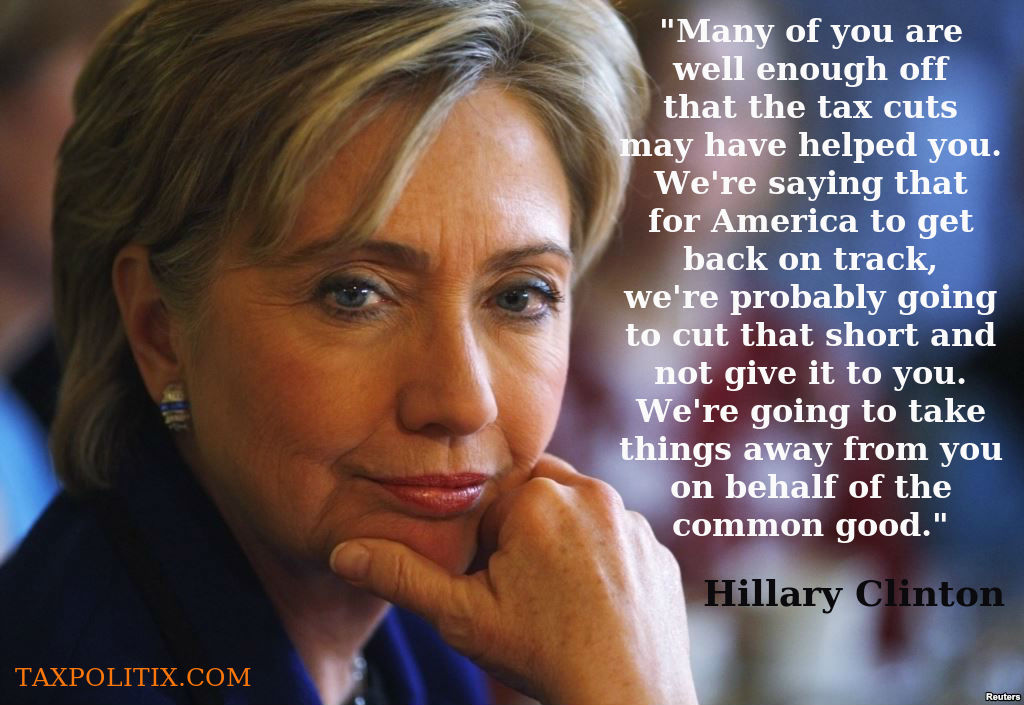

In 2004

by | BLOG, FREEDOM, GOVERNMENT, OBAMA, TAXES

Now we’ve gone from yes, we have emails —> no we don’t have emails because of a computer crash —-> the hard drive may have been recycled. Politico reports:

“Ex-IRS official Lois Lerner’s crashed hard drive has been recycled, making it likely the lost emails of the lightning rod in the tea party targeting controversy will never be found, according to multiple sources.

What’s more, “On Wednesday, the White House retorted that for the time frame in which Lerner’s emails are missing, there are no direct communications between 1600 Pennsylvania Ave. and the now-retired Lerner.

Earlier this week, Ways and Means Republicans said as many as six IRS employees involved in the scandal also lost email in computer crashes, including the former chief of staff for the acting IRS commissioner”

The WSJ calls this IRS Scandal “worse than Watergate“. ““The Watergate break-in was the professionals of the party in power going after the party professionals of the party out of power. The IRS scandal is the party in power going after the most average Americans imaginable”

At this point, I’m inclined to agree.

by | BLOG, FREEDOM, GOVERNMENT, OBAMA, TAXES

I joined the Tea Party in my locality when it began because I sincerely believed in its simple, but extremely powerful and direct message:

Low Taxes

Limited, Constitutional Government

Individual liberty

and nothing else. The Tea Party was not to be a political “Party” with positions on every subject under the sun. It would only be involved in its particular concerns, so as not to dilute its message.

Then what is this nonsense regarding certain Tea Party groups espousing substantial anti-immigration rhetoric?

How can someone espousing limited government, individual liberty, and rule of law be FOR crony capital government-imposed restrictions on businesses hiring who they want?

And with that, a large reason for such a high number of “illegal” immigrants is because the government has created arbitrary, low quotas which limit the amount of foreign-born workers allowed — though many sectors of our economy demand more.

The current Tea Party was galvanized by the original (Boston) Tea Party and share a same disdain over high and unjust taxation. But the original “tea partiers” would be turning over in their graves by being associated with the current Tea Party’s anti immigration stance!

Our colonists came to America for a variety of reasons ranging from freedom of religion to economic opportunity and wealth. They sought hope, prosperity, and freedom. They were the original immigrants.

America is a unique country because men, women, and children from other countries all want to come here. Unless you have a relationship to a US citizen or a permanent resident, the only way to be able to come here is through a job by being a skilled laborer or professional. This is a good thing.

We are getting the creme de la creme from other countries — and we want to say no to them? Here we have people who work and are motivated enough to uproot and better themselves by living in another country. That is the best kind of ethic we need to continue to nourish and aspire to America, the way we always have.

As for those who flee here from oppression: if their only crime is that they seek a better life, decent housing, food, and hygiene and they risk life and limb to come here, how can we turn that spirit away?

The current Tea Party would do well to remember that this country has survived and thrived precisely because of immigration; first, from the original colonists and second, from the wave of people who came here mainly during the late 1800s and early 1900s.

You are here because of an immigrant who believed in America. For the Tea Party to be closed-minded and protectionist on the issue of immigration flies in the face of the original Tea Partiers who inspired them.

by | ARTICLES, BLOG, ECONOMY, FREEDOM, GOVERNMENT, OBAMA, TAXES

From the Bureau of Labor Statistics (BLS):

Total nonfarm payroll employment rose by 217,000 in May, and the unemployment rate was unchanged at 6.3 percent, the U.S. Bureau of Labor Statistics reported today. Employment increased in professional and business services, health care and social assistance, food services and drinking places, and transportation and warehousing.

Household Survey Data

The unemployment rate held at 6.3 percent in May, following a decline of 0.4 percentage point in April. The number of unemployed persons was unchanged in May at 9.8 million. Over the year, the unemployment rate and the number of unemployed persons declined by 1.2 percentage points and 1.9 million, respectively.

Among the major worker groups, the unemployment rates for adult men (5.9 percent), adult women (5.7 percent), teenagers (19.2 percent), whites (5.4 percent), blacks (11.5 percent), and Hispanics (7.7 percent) showed little or no change in May. The jobless rate for Asians was 5.3 percent (not seasonally adjusted), little changed from a year earlier.

Among the unemployed, the number of job losers and persons who completed temporary jobs declined by 218,000 in May. The number of unemployed reentrants increased by 237,000 over the month, partially offsetting a large decrease in April. (Reentrants are persons who previously worked but were not in the labor force prior to beginning their current job search.)

The number of long-term unemployed (those jobless for 27 weeks or more) was essentially unchanged at 3.4 million in May. These individuals accounted for 34.6 percent of the unemployed. Over the past 12 months, the number of long-term unemployed has declined by 979,000.

The civilian labor force participation rate was unchanged in May, at 62.8 percent. The participation rate has shown no clear trend since this past October but is down by 0.6 percentage point over the year. The employment-population ratio, at 58.9 percent, was also unchanged in May and has changed little over the year.

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers), at 7.3 million, changed little in May. These individuals were working part time because their hours had been cut back or because they were unable to find a full-time job.

In May, 2.1 million persons were marginally attached to the labor force, essentially unchanged from a year earlier. (The data are not seasonally adjusted.) These individuals were not in the labor force, wanted and were available for work, and had looked for a job sometime in the prior 12 months. They were not counted as unemployed because they had not searched for work in the 4 weeks preceding the survey.

Among the marginally attached, there were 697,000 discouraged workers in May, little different from a year earlier. (The data are not seasonally adjusted.) Discouraged workers are persons not currently looking for work because they believe no jobs are available for them. The remaining 1.4 million persons marginally attached to the labor force in May had not searched for work for reasons such as school attendance or family responsibilities.

by | ARTICLES, BLOG, FREEDOM, GOVERNMENT, HYPOCRISY, POLITICS, TAXES

Many people this year are startled to find that the IRS is holding some or all of the portions of their tax return as a form of payment for old debt. Many so called debts are decades-old and often the debt is not even the debt of the taxpayer being targeted.

How did this happen? The first part of the process began in 2008, when Congress passed HR6124, The “Food, Conservation, and Energy Act 0f 2008”, commonly known as the “Farm Bill”. On page 594-594 of the 662 page document, Section 14219 reads. “Elimination of statute of limitations applicable to collection of debt by administrative offset”.

(a) ELIMINATION.—Section 3716(e) of title 31, United States

Code, is amended to read as follows: ‘‘(e)(1) Notwithstanding any other provision of law, regulation,

or administrative limitation, no limitation on the period within which an offset may be initiated or taken pursuant to this section shall be effective. (2) This section does not apply when a statute explicitly prohibits using administrative offset of setoff to collect the claim or type of claim involved.” (b) APPLICATION OF AMENDMENT — The amendment made by subsection (a) shall apply to any debt outstanding on or after the date of the enactment of this Act.

As a result of this legislation, the Department of the Treasury issued 74 FR 68537: “OFFSET OF TAX REFUND PAYMENTS TO COLLECT PAST-DUE, LEGALLY ENFORCEABLE NONTAX DEBT” on December 28, 2009. The Department of the Treasury, Financial Management Service made changes to it how it dealt with non-tax debts owed by taxpayers. This rule allowed the “ offset of Federal tax refunds irrespective of the amount of time the debt has been outstanding”.

I. Background

“The Food, Conservation and Energy Act of 2008, Public Law 110–234,

Section 14219, 22 Stat. 923 (2008) (‘‘the Act’’) amended the Debt Collection Act

of 1982 (as amended by the Debt Collection Improvement Act of 1996) to

authorize the offset of Federal nontax payments (for example, contract and salary payments) to collect delinquent Federal debt without regard to the amount of time the debt has been delinquent. Prior to this change, nontax payments could be offset only to collect

debt that was delinquent for a period of less than ten years. There is no similar time limitation in the statutes authorizing offset of Federal tax refund payments to collect Federal

nontax debts (see 26 U.S.C. 6402(a) and 31 U.S.C. 3720A). However, Treasury had imposed a time limitation on collection of debts by tax refund offset in order to create uniformity in the way that it offset payments. Now that the ten-year limitation has been eliminated for the offset of nontax payments, the rationale for including a ten-year limitation for the offset of tax refund payments no longer applies.

Therefore, on June 11, 2009, Treasury issued a notice of proposed rulemaking proposing to remove the limitations period by explicitly stating that no time limitation shall apply. See 74 FR 27730. The proposed rule explained that by removing the time limitation, all Federal nontax debts, including debts that were ineligible for collection by offset prior to the removal of the limitations period, may now be collected by tax refund offset. Additionally, to avoid any undue hardship, Treasury proposed the addition of a notice requirement applicable to debts that were previously ineligible for collection by offset because they had been outstanding for more than ten years. For such debts, creditor agencies must certify to FMS that a notice of intent to offset was sent to the debtor after the debt became ten years delinquent. This notice of intent to offset is meant to alert the debtor that any debt the taxpayer owes to the United States may now be collected by offset, even if it is greater than ten years delinquent. It also allows the debtor additional opportunities to dispute the debt, enter into a repayment agreement or otherwise avoid offset. This requirement will apply even in a case where notice was sent prior to the debt becoming ten years old. This requirement applies only with respect to debts that were previously ineligible for collection by offset because of the previous time limitation. Accordingly, it does not apply with respect to debts that could be collected by offset without regard to any time limitation prior to this regulatory change—for example, Department of Education student loan debts.”

The ramifications of this rule change has been far reaching. One agency, the IRS, has used it to justify going after old debts by holding tax refunds. This is a growing problem, because the agency has begun going after relatives of the phantom debt, not the debt-holder themselves.

According to the Treasury rule, “For such debts, creditor agencies must certify to FMS

that a notice of intent to offset was sent to the debtor after the debt became ten years delinquent. This notice of intent to offset is meant to alert the debtor that any debt the taxpayer owes to the United States may now be collected by offset, even if it is greater than ten years delinquent”.

The rule does not state “relative of the debtor”. In several instances this year alone, the targeted person was a relative of the debt-holder, not the debt-holder themselves, and every one of them stated they received no notice or advance warning from the IRS before the IRS decided to withhold their refund. The IRS has no right to do so.

There exists a process called “transferee liability” where the IRS can go after the debts of a relative. It is a high burden process and is not done easily. Such a scenario might be if a person died with $100,000 in a bank account, which was bequeathed to a child. Then later, it was revealed that the original account holder owed the IRS, which really should have been discovered by the person doing the estate process, and thus the money received by bequeathment could be considered as being received under false pretenses. The IRS in this situation could make a case, under “transferee liability”, that it has a right to go after the relative for that money.

Obviously, this above scenario is much different than resurrecting decades-old debt via an obscure provision in a 662 page bill. Those affected by it should demand proof of debt as well as argue that the debt is not theirs. However, in the cases where the IRS merely held the tax refund, the “debtor” did not receive due process and is at the mercy of trying to deal with a convoluted, poorly run government agency. Most people do not have the time or means to fight back. This action taken by the IRS is legal plunder, plain and simple.

by | ARTICLES, BLOG, BUSINESS, ECONOMY, ELECTIONS, FREEDOM, GOVERNMENT, HYPOCRISY, POLITICS

Oh, the hypocrisy!

In February, it was announced that retired hedge-fund billionaire Tom Steyer, has committed $100 million of his own money to “to make climate change a priority issue in this year’s midterm elections.”

How can this possibly be? First, Steyer made his millions as a hedge-fund operator — which is typically and universally denounced as a greedy profession. But if he spends his greedy millions on items considered tolerable and suitable to the political Left, it’s becomes okay.

That same political Left decries the Koch Brothers who are accused of funding groups with their obscene amounts of money to promote policy positions. The Koch Brothers made their money as businessmen, which clearly is repugnant. It begs the question: why does Harry Reid go after the Koch Brothers and turns a blind eye to Steyer’s tactics?

In reality, what Tom Steyer is doing is much worse. Steyer is essentially telling a political candidate, “if you take this position, I will give you money”. Isn’t this line of thinking exactly what the Supreme Court was trying to stop? How is this okay? Because it works for the Left.

Steyer’s game proved effective in 2013 when his NextGen Climate Action Super Pac spend $2.5 million to target conservative-leaning coal areas of Southwest Virginia on behalf of Democrat gubernatorial candidate Terry McAuliffe. Coupled with Mayor Bloomberg’s Independence USA Super PAC which spent roughly $2 million on ads in Virginia to target Republican candidate Ken Cuccinelli’s position on gun-rights, the two out-of-staters helped lead the Democrat to victory.

Steyer’s next plan is to influence the 2014 midterms. His money is planning on being spent on “attack ads during the election, including the Florida governor’s race and the Iowa Senate race.

Clearly, Steyer’s actions are appropriate for the 2014 elections, because political candidates with the “proper positions” are able to benefit from Steyer’s “generosity”. Yet in contrast, other organizations are called out for being “tainted” by the Koch Brothers for merely promoting various policies that the Left deems unacceptable. Either it’s okay for both, or for neither.

The double standard prevails.

by | ARTICLES, BLOG, ECONOMY, HYPOCRISY, OBAMA

Can you believe it — a bigger lie than “you can keep your doctor”?

President Obama’s comments regarding the gender pay gap and discrimination are as vicious a lie as his statements that you can keep your doctor. The idea that women earn $.77 for every $1.00 that men earn, for equal work, has never been true, never in the slightest.

That $.77 comparison is not for equal work. It strictly represents the reality that women, more often than men, work at jobs that are lower paying. The reason for such jobs might include school and family situations, flexibility of schedule, and their desires to be able to be use work secondarily for their needs for their families or a source of discretionary income.

There is actually no evidence of any discrimination for women doing the same work an being paid less. If the world of labor could indeed pay women less (23% less) for equal work, why isn’t virtually every company hiring only women as a means to curb costs and increase profit?

A more full and excellently written description was put forth in the WSJ on April 7th. It is a must read.

The most incredible thing about Obama’s statements is that Obama appears to have his own “pay gap disparity” at the White House (women earn $.88 cents per $1.00 for men). Interestingly, the White House takes great pains to discuss the discrimination variables that cause this disparity.

“An analysis of staff salaries done last fall by the conservative American Enterprise Institute found the president’s female aides were paid 88 cents for every dollar paid to men, about $65,000 to $73,729 annually. On Monday, Carney argued the comparison is based on aggregate wages that include the lowest salaries at the White House “which may or may not be — depending on the institution — filled by more women than men.”

He said men and women in equivalent roles at the White House earn the same amount and that 10 of 16 department heads are women, earning the top White House salary of $172,200″.

Here we have the Obama administration admitting that more women are in jobs that include the lowest salaries at the White House.

So, it is not gender discrimination at the White House, which is what Obama has tried to claim in his “$.77 cents” missive and new Executive Order. He wants to apply that label when discussing the “gender pay gap” to all other businesses (as a means to appeal to his female base), but then when the spotlight is shined on the White House pay scale, Obama retreats from that rhetoric.

As he should. Because the gender pay gap is truly a myth. And Obama’s own White House data and discussion prove it.

by | ARTICLES, BLOG, FREEDOM, GOVERNMENT, NEW YORK, OBAMACARE

Would any consumer-driven industry be able to get away with this?

“Surprise medical bills occur when a consumer does everything possible to use hospitals and doctors that are in the consumer’s insurance plan, but nonetheless receives a bill from a specialist or other medical provider by whom the consumer did not know he or she would be treated, and who was outside his or her plan’s network of providers.

Worse, a relatively small but significant number of out-of-network specialists appear to take advantage in emergency care situations in particular, where the consumer has little choice or ability to “shop” for an appropriate provider. Too frequently, out-of-network specialists charge excessive fees — many times larger than what private or public insurers typically allow. In one example, a New Yorker who severed his finger in an accident went to participating hospital and ultimately received an $83,000 bill from a plastic surgeon who reattached the finger but – unbeknownst to the patient — was outside the insured’s network of providers.

The problem of surprise bills is not limited to emergency situations. They also can occur when a consumer schedules health care services in advance and an in-network provider, such as an anesthesiologist, is not available. In these instances, consumers are not told that the provider is out-of-network, not informed about how much the provider will charge, or not advised how much the insurer will cover. This lack of disclosure not only ill serves the consumer, but also undermines the efficiency of the health insurance market because consumers cannot effectively comparison shop for benefits or services”

This except from is part of a larger letter from Benjamin M. Lawsky, Superintendent of Financial Services for New York State, written to members of the New York State Legislature. You can read the letter here.

In any other industry, this would ALL be considered fraud.