by | ARTICLES, BLOG, CONSTITUTION, FREEDOM, GOVERNMENT, HYPOCRISY, OBAMA, POLITICS, TAXES

Eric Holder recently announced his plan to move forward with prosecuting “campaign-finance “coordination” between candidates and outside groups.” This is ridiculous.

Holder has the time to do this, but yet he hasn’t even begun to compose a report on the IRS — which everyone now knows is full of very serious breaches of impropriety.

How can he find the time to develop the politically charged concept of coordination (with no real evidence); investigations are based merely on supposition. In contrast, we have actual facts and actions with regard to the IRS fiasco — which was also politically charged — and Holder has done nothing so far.

Even the WSJ recognizes the farce that this “coordination” campaign is, pointing out that “the federal government can subpoena your documents, email, computers and bank records in a political fishing expedition conducted by the FBI.”

And more: “A coordination investigation can be started on almost any pretext. All you need is an allegation that someone talked to someone they should not have. Once the investigation makes it over that low evidentiary hurdle, the feds can comb through every shred of personal and group communications to find illegal contact.”

Why is the same diligence not being applied to the substantiated, documented IRS abuses? Where is the Department of Justice report on this egregious overreach by another federal department?

Unfortunately, we already know the answer.

2015/2016 is shaping up to be a particularly nasty election cycle. You can read the scathing WSJ opinion on the matter of “coordination” here:

by | ARTICLES, BLOG, GOVERNMENT, OBAMA, POLITICS, TAXES

So, President Obama’s FY2016 budget suffered a major defeat (again) on Tuesday night, when the Senate voted against it 98-1. This would not be the first time Obama’s budgets have been readily rejected.

Already, Republicans and Democrats had their own interpretation of what that vote meant.

“Democrats objected, saying the plan wasn’t really Mr. Obama’s, but Republicans said it had all the same numbers as the president’s blueprint, and so the vote counts as a rejection of his fiscal year 2016 plan.

“This is the president’s proposed budget,” said Sen. John Cornyn, the Texas Republican who forced the vote by offering the amendment, complete with the tax hikes, spending increases and deficit targets Mr. Obama had projected in the document he sent to Congress last month….

Sen. Bernard Sanders, Vermont independent and Democrats’ point man on the budget, said the plan Mr. Cornyn offered didn’t include a minimum wage increase or some of Mr. Obama’s other policy prescriptions, so it wasn’t a legitimate representation of his budget. ‘It is not what President Obama presented to the American people,’ Mr. Sanders said.”

Remember, this was the budget that Obama pushed forth touting “middle class economics”, both on paper and during his State of the Union. This was the $4 Trillion budget, with $2 Trillion in tax hikes over the next decade. This was the budget that used fuzzy math to boast a higher deficit reduction than it could actually deliver.

The budget rejection was reminiscent of most of the past budgets that Obama has offered. His FY2013 budget was defeated 0-99 in the Senate and 0-414 in the House; in FY2012 it was 97-0. No one wants to put their names to it.

Obama submitted his FY2014 budget late by two months, in April of this year. By that time, the House had already created and voted on a budget, as did the Senate (first time for the Senate in a few years). Incidentially, Obama’s budgets were late 4 out of 5 budget cycles through FY2014, (breaking the law, mind you), with 2010 being the only year he submitted it on time.

At least we can say that opposition to Obama’s budgets through the years have been both bicameral and bipartisan. Yes, we can!

by | BLOG, FREEDOM, GOVERNMENT, POLITICS

Patrick Henry

March 23, 1775

St. John’s Church, Richmond, Virginia

MR. PRESIDENT: No man thinks more highly than I do of the patriotism, as well as abilities, of the very worthy gentlemen who have just addressed the House. But different men often see the same subject in different lights; and, therefore, I hope it will not be thought disrespectful to those gentlemen if, entertaining as I do, opinions of a character very opposite to theirs, I shall speak forth my sentiments freely, and without reserve. This is no time for ceremony. The question before the House is one of awful moment to this country. For my own part, I consider it as nothing less than a question of freedom or slavery; and in proportion to the magnitude of the subject ought to be the freedom of the debate. It is only in this way that we can hope to arrive at truth, and fulfill the great responsibility which we hold to God and our country. Should I keep back my opinions at such a time, through fear of giving offence, I should consider myself as guilty of treason towards my country, and of an act of disloyalty toward the majesty of heaven, which I revere above all earthly kings.

Mr. President, it is natural to man to indulge in the illusions of hope. We are apt to shut our eyes against a painful truth, and listen to the song of that siren till she transforms us into beasts. Is this the part of wise men, engaged in a great and arduous struggle for liberty? Are we disposed to be of the number of those who, having eyes, see not, and, having ears, hear not, the things which so nearly concern their temporal salvation? For my part, whatever anguish of spirit it may cost, I am willing to know the whole truth; to know the worst, and to provide for it.

I have but one lamp by which my feet are guided; and that is the lamp of experience. I know of no way of judging of the future but by the past. And judging by the past, I wish to know what there has been in the conduct of the British ministry for the last ten years, to justify those hopes with which gentlemen have been pleased to solace themselves, and the House? Is it that insidious smile with which our petition has been lately received? Trust it not, sir; it will prove a snare to your feet. Suffer not yourselves to be betrayed with a kiss. Ask yourselves how this gracious reception of our petition comports with these war-like preparations which cover our waters and darken our land. Are fleets and armies necessary to a work of love and reconciliation? Have we shown ourselves so unwilling to be reconciled, that force must be called in to win back our love? Let us not deceive ourselves, sir. These are the implements of war and subjugation; the last arguments to which kings resort. I ask, gentlemen, sir, what means this martial array, if its purpose be not to force us to submission? Can gentlemen assign any other possible motive for it? Has Great Britain any enemy, in this quarter of the world, to call for all this accumulation of navies and armies? No, sir, she has none. They are meant for us; they can be meant for no other. They are sent over to bind and rivet upon us those chains which the British ministry have been so long forging. And what have we to oppose to them? Shall we try argument? Sir, we have been trying that for the last ten years. Have we anything new to offer upon the subject? Nothing. We have held the subject up in every light of which it is capable; but it has been all in vain. Shall we resort to entreaty and humble supplication? What terms shall we find which have not been already exhausted? Let us not, I beseech you, sir, deceive ourselves. Sir, we have done everything that could be done, to avert the storm which is now coming on. We have petitioned; we have remonstrated; we have supplicated; we have prostrated ourselves before the throne, and have implored its interposition to arrest the tyrannical hands of the ministry and Parliament. Our petitions have been slighted; our remonstrances have produced additional violence and insult; our supplications have been disregarded; and we have been spurned, with contempt, from the foot of the throne. In vain, after these things, may we indulge the fond hope of peace and reconciliation. There is no longer any room for hope. If we wish to be free² if we mean to preserve inviolate those inestimable privileges for which we have been so long contending²if we mean not basely to abandon the noble struggle in which we have been so long engaged, and which we have pledged ourselves never to abandon until the glorious object of our contest shall be obtained, we must fight! I repeat it, sir, we must fight! An appeal to arms and to the God of Hosts is all that is left us!

They tell us, sir, that we are weak; unable to cope with so formidable an adversary. But when shall we be stronger? Will it be the next week, or the next year? Will it be when we are totally disarmed, and when a British guard shall be stationed in every house? Shall we gather strength by irresolution and inaction? Shall we acquire the means of effectual resistance, by lying supinely on our backs, and hugging the delusive phantom of hope, until our enemies shall have bound us hand and foot? Sir, we are not weak if we make a proper use of those means which the God of nature hath placed in our power. Three millions of people, armed in the holy cause of liberty, and in such a country as that which we possess, are invincible by any force which our enemy can send against us. Besides, sir, we shall not fight our battles alone. There is a just God who presides over the destinies of nations; and who will raise up friends to fight our battles for us. The battle, sir, is not to the strong alone; it is to the vigilant, the active, the brave. Besides, sir, we have no election. If we were base enough to desire it, it is now too late to retire from the contest. There is no retreat but in submission and slavery! Our chains are forged! Their clanking may be heard on the plains of Boston! The war is inevitable²and let it come! I repeat it, sir, let it come.

It is in vain, sir, to extenuate the matter. Gentlemen may cry, Peace, Peace²but there is no peace. The war is actually begun! The next gale that sweeps from the north will bring to our ears the clash of resounding arms! Our brethren are already in the field! Why stand we here idle? What is it that gentlemen wish? What would they have? Is life so dear, or peace so sweet, as to be purchased at the price of chains and slavery? Forbid it, Almighty God! I know not what course others may take; but as for me, give me liberty or give me death!

by | ARTICLES, BLOG, ECONOMY, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAX TIPS, TAXES

March 23, 2010: Obamacare was signed into law by President Obama. How have we fared since then? Sally Pipes over at NYDailyNews gives a good overview of how Obamacare has failed to live up to its expectations.

“Obamacare turns five years old today. But there’s little to celebrate.

When he signed his signature piece of legislation into law, President Obama guaranteed lower health-care costs, universal coverage and higher-quality care. Americans wouldn’t have to change their doctors if they didn’t want to. Five years later, the health law has failed to fulfill those grandiose promises.

“In the Obama administration,” candidate Obama boasted in 2008, “we’ll lower premiums by up to $2,500 for a typical family in a year.”

Not quite. A recent report from the National Bureau of Economic Research examined the non-group marketplace, where families and individuals who don’t get coverage through work shop for insurance. The report concluded that 2014 premiums were 24.4% higher than they would have been without Obamacare.

On Obamacare’s third birthday, the White House reassured Americans the law would protect vulnerable patient populations from increases in drug prices.

“Preventing them from being charged more because of a pre-existing condition or getting fewer benefits like mental health services or prescription drugs,” was a key purpose of the law, explained the White House.

Instead, drug costs for these patients have skyrocketed. The majority of health plans on the exchanges have shifted costs for expensive medications onto patients.

In 2015, more than 40% of all “silver” exchange plans — the most commonly purchased — are charging patients 30% or more of the total cost of their specialty drugs. Only 27% of silver plans did so last year.

Part of the problem is that Obamacare has quashed competition.

The president promised in 2013 that “this law means more choice, more competition, lower costs for millions of Americans.” But that hasn’t turned out to be true. According to the Heritage Foundation, the number of insurers selling to individual consumers in the exchanges this year is 21.5% less than the number on the market in 2013 — the year before the law took effect.

The Government Accountability Office reports that insurers have left the market in droves. In 2013, 1,232 carriers offered insurance coverage in the individual market. By 2015, that number had shrunk to 310.

A man looks over the Affordable Care Act (commonly known as Obamacare) signup page on the HealthCare.gov website in New York in this October 2, 2013 photo illustration.

As competition in the exchanges declines, so does quality — just like Obama inadvertently predicted in 2013, when he said: “without competition, the price of insurance goes up and the quality goes down.”

Consumers who purchase insurance on the law’s exchanges have fewer options than they had pre-Obamacare. McKinsey & Co. noted that roughly two-thirds of the hospital networks available on the exchanges were either “narrow” or “ultra-narrow.” That means that these insurance plans refuse to partner with at least 30% of the area’s hospitals. Other plans exclude more than 70%.

Patients may also have fewer doctors to pick from. More than 60% of doctors plan to retire earlier than anticipated — by 2016 or sooner, according to Deloitte. The Physicians Foundation reported in the fall that nearly half of the 20,000 doctors who responded to their survey — especially those with more experience — considered Obamacare’s reforms a failure.

The Obama administration claims the health-care law has been a success because millions have gained insurance coverage. But that coverage is worthless if they can’t find a doctor or hospital who will see them.

Further, as many as 89% of the Americans who signed up for Obamacare when the exchanges opened in 2013 already had insurance. In other words, many exchange enrollees simply switched from one plan to another.

And the law is set to cover far fewer people than initially promised. In March 2011, the Congressional Budget Office forecast that 34 million uninsured would gain insurance thanks to Obamacare by 2021. But this month, the agency revised that estimate to 25 million obtaining coverage by 2025.

Covering those people isn’t cheap. This month, the CBO estimated the law’s 10-year cost will reach $1.2 trillion — a far cry from the President’s initial promise of $940 billion.

So much for President Obama’s five-year-old declaration that he would not sign a plan that “adds one dime to our deficits — either now or in the future.”

Time and again, Obama has been proven wrong about what his health law would accomplish. Quality hasn’t improved, and costs continue to grow out of control. So far at least, that’s Obamacare’s legacy.”

by | ARTICLES, BLOG, OBAMA, OBAMACARE, POLITICS, TAX TIPS, TAXES

There have been many reports about incorrect 1095A forms being sent out. The 1095A (the Health Insurance Marketplace Statement), is the form that the government sends you if you enrolled in an Obamacare plan last year, and is your proof of insurance. This form is necessary in order to fill out your 8562 worksheet on your 2014 tax form. For more about the 1095A, go here and here .

Considering that only 6.7 million people enrolled in and paid for an Obamacare plan in 2014 (after adjusting for counting dental plans), it’s pretty terrible that the Administration sent out about 820,000 incorrect 1095A forms; that’s about 12-13% of all enrollees.

The original forms were supposed to arrive in everyone’s mailbox by January 31st (like W-2s and 1099s), but then the Administration pushed that arrival date into the first week of February. Now we are in the 3rd week of March. All the people who have incorrect 1095As have been delayed in filing their taxes.

But, a correction is near!

“Federal officials said on a Friday press call that about 740,000 corrected forms have been mailed out or can be downloaded from the HealthCare.gov site. About 80,000 corrected forms will be mailed and available online next week, they said.

Consumers who already filed their tax returns using the incorrect forms provided though state or federal exchanges won’t be required to file amended forms, and the Internal Revenue Service won’t assess additional taxes, said Mark Mazur, the Treasury Department’s assistant secretary for tax policy.

The Obama administration may re-evaluate filing extensions because of the incorrect forms, but at this time, April 15 is the end of tax-filing season based on statute, officials said.”

So all these people have had to wait an additional 7-8 weeks for a correct 1095A form that they are required by the federal government to have in order to correctly calculate their “Premium Tax Form” (Form 8562) on their 2014 taxes, because the federal government screwed up their forms in the first place. Now they have to scramble to finish their taxes by April 15th.

Good luck to the Obamacare victims.

by | ARTICLES, BLOG, CONSTITUTION, ECONOMY, GOVERNMENT, OBAMA, POLITICS, TAXES

In Obama’s Keystone recent veto message to Congress, our President cited the ongoing State Department review as the basis for his decision. He stated, “And because this act of Congress conflicts with established executive branch procedures and cuts short thorough consideration of issues that could bear on our national interest — including our security, safety, and environment — it has earned my veto.”

How incredibly obnoxious and incompetent is the President to say that after SIX years, the State Department has failed to complete its review. Nothing else at all needs to be said as to why the economy is still deplorable. The Keystone saga encapsulates the entire failure of the “shovel ready jobs” schtick, if it takes six years and counting for the federal government to make a decision on one pipeline project.

by | ARTICLES, BLOG, BUSINESS, OBAMA, POLITICS, TAXES

As I read this recent article in the Wall Street Journal, “Sluggish Productivity Hampers Wage Gains” I mulled as to whether or not the Wall Street Journal had started a new satire section — but then it occurred to me that the author’s analysis of the current market was completely serious. Is he so clueless that he actually does not understand why there is “tepid productivity”?

The author, Greg Ip, cites 1) Faulty data may be partly to blame, 2) the severity of the financial crisis and recession and 3) weak business investment, but completely misses the elephant in the room: the meddling, anti-business policies of the current administration.

This administration has been exceedingly heavy-handed in its efforts to demonize businesses, while promising that businesses will be highly taxed and regulated. Whether it is labor regulation by the NRLB or environmental regulation by the EPA, government interference has been overreaching and restrictive.

Additionally, there have been huge increases in both criminal rules and regulations about what businesses are allowed and not allowed to do — from nitpicky labor rules, to dictating employee minutiae, to minimum wage requirements, all which restrict business hiring.

More unfortunately, Obama has provided the background for a litigation-friendly environment. If a larger, more financially stable company wants to steal something from a smaller company, they can sue them or just threaten with a costly legal battle. Likewise, “disparate impact” and IRS asset forfeiture are two practices which demonize business owners by merely suggesting wrongdoing — and put the burden of the business owners to prove their innocence.

And recently, the Obama Administration has decided to wage war on business inversions, by declaring companies who wish to move their headquarters abroad in order to stay competitive, to be “unpatriotic”, and “tax dodgers”, calling the perfectly legal process of inversion to be a “loophole”. Couple that with the fact that we have the highest corporate tax rate in the world and it’s no wonder that businesses struggle to survive.

Usually the Wall Street Journal is fairly en pointe. It’s hard to believe any editor would have let this article be published while utterly ignoring Obama’s detrimental business policies that have plagued the economy over the last 6 years — which is why something needed to be said.

by | ARTICLES, BLOG, CONSTITUTION, FREEDOM, GOVERNMENT, NEW YORK, OBAMA, POLITICS, TAXES

The Wall Street Journal had an excellent article a couple weeks ago calling out the egregious prosecutorial misconduct of New York Attorney General Eric Schneiderman. In this farce of a case, Schneiderman is hell bent on going after Hank Greenberg (formerly with AIG) in an attempt to discredit his name in a state civil lawsuit. The manner in which Schneiderman is conducting himself is a disgrace to his position as prosecutor and reflects a trend of prosecutorial abuses that has grown alarmingly in recent years.

In the Schneiderman-Greenberg case, Eric Schneiderman has been pursuing civil charges against Hank Greenberg related to an “allegedly fraudulent reinsurance transaction” some years ago while disgraced Eliot Spitzer was the Attorney General. Mr. Greenberg was the defendant in a prior, failed criminal prosecution involving this particular transaction several years ago; in preparation for this upcoming civil case, it came to light that the “federal government has been hiding potentially exculpatory evidence” from the prior trial of Mr. Greenberg. The key witness for the government in that case, a Mr. Napier, who never had any direct communication with Mr. Greenberg about the deal in question apparently provided such “compelling inconsistencies” that an Appeals judge wrote “Napier may well have testified falsely.” Yet, Napier’s testimony is the very piece of evidence upon which Schneiderman has built his civil case.

For several years, and as recently as January, the federal government continued to claim that the notes and evidence collected during the first case should be kept under seal. It was only recently, under pressure, that the prosecutors relented and provided that notes and memos which showed the blatant inconsistencies of Mr. Napier. Had that release not occurred, however, Mr. Schneiderman would have been allowed to pursue the civil case against Greenberg relying “on a Napier deposition conducted years before the appeals court cast doubt on his testimony and before Mr. Greenberg’s legal team uncovered the notes.” What’s more, Mr. Greenberg was denied a trial by jury, and because “it’s a civil case and Mr. Napier doesn’t live in New York, he cannot be compelled to appear.” Thankfully, in light of the new exculpatory evidence, the trial has been stayed to decide whether or not to continue with the farce.

It is clear that Schneiderman’s decision to doggedly pursue this case for years even in the face of tainted, unreliable evidence is abusive. Schneiderman himself should be under investigation for malicious prosecution, going after a “big name” for his own political and personal gain.

This unprofessional prosecutorial behavior is unfortunately not limited to Eric Schneiderman. The nominee for Attorney General, Loretta Lynch, who also hails from New York has an egregious record of abuse particularly relating to civil asset forfeiture while she was the U.S. Attorney for the Eastern District of New York. In the most outrageous case during her tenure, her offices colluded with the IRS to seize nearly $450,000 from the bank account of two businessmen known as the Hirsch Brothers in May 2012, for “suspicion”, not actual charges, of criminal activity.

For nearly 3 years, the brothers were never charged with any crime, and Lynch’s office wholy ignored stringent deadlines regarding forfeiture cases. Prosecutors were compelled by law to file a court complaint within a certain amount of days following the seizure, but that never actually happened at any time, and the Hirsch brothers never had the opportunity to appear before a judge. In fact, there was never any case presented against them at anytime; Lynch’s office just sat on the seized money, all while offering to cut a deal with the brothers to keep some of the funds in return for dropping the matter. The brothers turned down every offer made to them.

Suddenly, a week before the Lynch’s confirmation hearing, in late January 2015 — two years and eight months after the case began — Lynch’s office returned all the money to the brothers. Lynch’s office clearly violated the law in the manner by which her prosecutors ignored forfeiture rules and denied due process to the Hirschs while going after the “big money”.

In a similar manner, NBC has covered another practice of Lynch’s office: using the “John Doe” alias in an overwhelmingly high amount to keep witness and court information from becoming public information. “Federal prosecutors in New York’s Brooklyn-based Eastern District pursued cases against secret, unnamed “John Doe” defendants 58 times since Loretta Lynch became head prosecutor in May 2010.” In comparision to others, “none of the nation’s 93 other federal district courts has charged more than eight “Does” during the same time period, and the national average is under four.” National Review has also covered the specifics of some of these cases, calling out Lynch’s “secret docket”. The repeated use of such secrecy invites Lynch’s office to the criticism that such practice undermines the right to a public trial guaranteed by our Constitution.

The conduct of Schneiderman and Lynch is unacceptable. The fact that Schneiderman is and will remain the Attorney General for New York and Loretta Lynch is poised to become the next Attorney General for the United States is disconcerting. It is not the first and it certainly won’t be the last, but it is increasingly brazen. This type of behavior undermines the integrity of our justice system when the nations leading prosecutors can’t be bothered to follow the rules and conduct themselves in an unbiased, professional manner. How can citizens protect their liberties in the face of such prosecutorial abuse?

by | ARTICLES, BLOG, BUSINESS, CONSTITUTION, ECONOMY, ELECTIONS, FREEDOM, GOVERNMENT, OBAMA, POLITICS, QUICKLY NOTED, TAXES

Bernie Sanders recently advocated for President Obama to raise $100 billion in taxes by the old “closing corporate loopholes” schtick. The difference this time, is that Obama is actively exploring his abilities to do so via Executive Order. Townhall has the scoop:

“White House Press Secretary Josh Earnest confirmed Monday that President Obama is “very interested” in the idea of raising taxes through unitlateral executive action.

“The president certainly has not indicated any reticence in using his executive authority to try and advance an agenda that benefits middle class Americans,” Earnest said in response to a question about Sen. Bernie Sanders (I-VT) calling on Obama to raise more than $100 billion in taxes through IRS executive action.

“Now I don’t want to leave you with the impression that there is some imminent announcement, there is not, at least that I know of,” Earnest continued. “But the president has asked his team to examine the array of executive authorities that are available to him to try to make progress on his goals. So I am not in a position to talk in any detail at this point, but the president is very interested in this avenue generally,” Earnest finished.

Sanders sent a letter to Treasury Secretary Jack Lew Friday identifying a number of executive actions he believes the IRS could take, without any input from Congress, that would close loopholes currently used by corporations. In the past, IRS lawyers have been hesitant to use executive actions to raise significant amounts of revenue, but that same calculation has change in other federal agencies since Obama became president.

Obama’s preferred option would be for Congress to pass a corporate tax hike that would fund liberal infrastructure projects like mass transit. But if Congress fails to do as Obama wishes, just as Congress has failed to pass the immigration reforms that Obama prefers, Obama could take actions unilaterally instead. This past November, for example, Obama gave work permits, Social Security Numbers, and drivers licenses to approximately 4 million illegal immigrants.

Those immigration actions, according to the Congressional Budget Office, will raise federal deficits by $8.8 billion over the next ten years.”

by | ARTICLES, BLOG, FREEDOM, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAXES

Yesterday it was reported that the Treasury Department paid $3 billion to cover Obamacare cost-sharing subsidies without Congressional approval. The heart of the dispute appears to be whether or not these subsidies were supposed to be funded via yearly appropriations or not. The House Ways and Means Chair, Paul Ryan, argues the former. Health and Human Services, via the Department of Justice, argues the latter.

In order to make sense of the funding dispute, it seemed necessary to dig around in the agency budgets to see how cost sharing was accounted for. Cost-sharing falls under the purview of the “Centers for Medicare & Medicaid Services (CMS)”. Yet, while comparing the budget requests for 2014 (for which the Treasury covered costs) and the ones for 2015 (current) & 2016 (future), it became clear that CMS changed the way it accounted for cost-sharing funding after 2014.

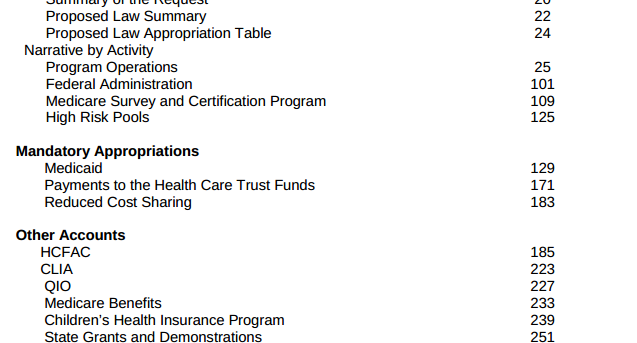

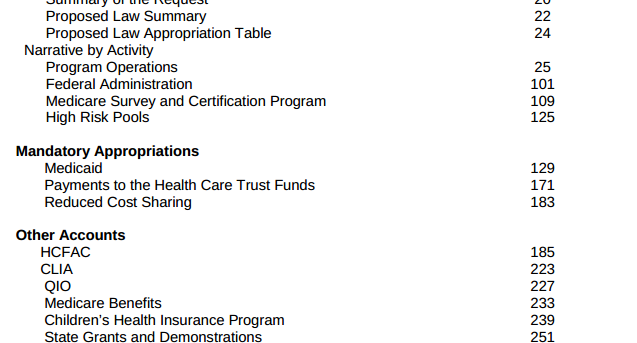

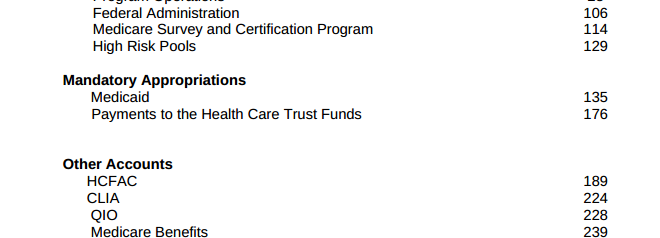

Looking at the 2014 Budget request, CMS had section called “Mandatory Appropriations”, which listed three items: 1) Medicaid 2) Payments to the Health Care Trust Funds 3) Reduced Cost Sharing.

Further in that budget, CMS wrote, “The FY 2014 request for Reduced Cost Sharing for Individuals Enrolled in Qualified Health Plans is $4.0 billion in the first year of operations for Health Insurance Marketplaces, also known as Exchanges. CMS also requests a $1.4 billion advance appropriation for the first quarter of FY 2015 in this budget to permit CMS to reimburse issuers who provided reduced cost-sharing in excess of the monthly advanced payments received in FY 2014 through the cost-sharing reduction reconciliation process.”

This position — that Obamacare cost-savings was to be funded by yearly appropriations– was reiterated by a “July 2013 letter to then Sen. Tom Coburn, Congressional Research Service wrote that, “unlike the refundable tax credits, these [cost-sharing] payments to the health plans do not appear to be funded through a permanent appropriation. Instead, it appears from the President’s FY2014 budget that funds for these payments are intended to be made available through annual appropriations.” (Remember, a 2014 budget would have been written also in 2013)

You can see a picture of the 2014 budget here:

However, Congress rejected those requested appropriations at the time so “the administration went ahead and made the payments anyway.” That is the mystery $3 billion paid for by the Treasury.

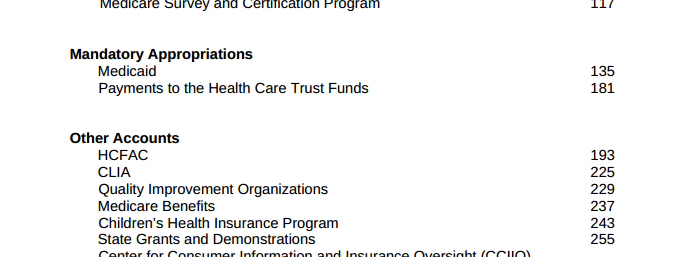

There is a noticeable change, however, with the CMS budget for 2015. The cost-sharing portion, which was originally listed as “Mandatory Payments” in 2014, is not listed at a “Mandatory Payment” anymore. Nor is it for 2016 either.

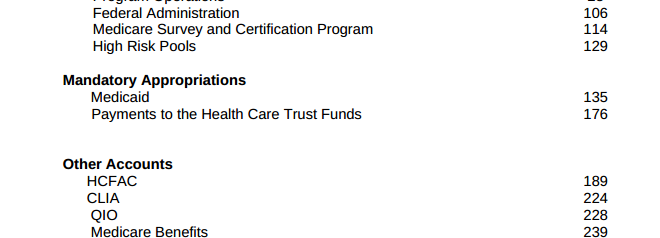

2015 Budget request:

CMS Budget 2015

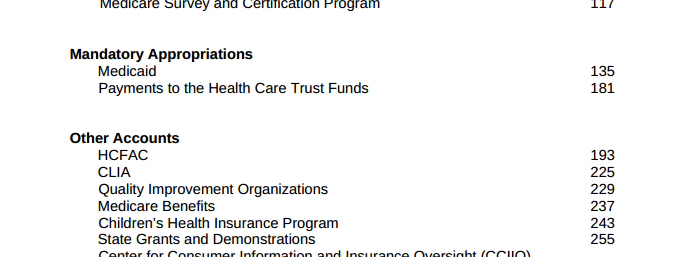

2016 Budget request:

CMS Budget 2016

Reading through the 2015 and 2016 budget documents, “cost sharing” appears in various areas, usually related to Medicaid, but not in one specific section — contrary to how it was accounted for in 2014, as a specific appropriation from the agency.

What’s equally interesting is that the DoJ argued about this specific matter in their recent brief dated January 26, 2015, saying that, “The House’s statutory arguments are incorrect. The cost sharing reduction payments are being made as part of a mandatory payment program that Congress has fully appropriated. See 42 U.S.C. § 18082. With respect to Section 4980H, Treasury exercised its rule making authority, as it has on numerous prior occasions, to interpret and to phase in the provisions of a newly enacted tax statute. See 26 U.S.C. § 7805(a).”

Yet, as shown above, the “mandatory program for cost-sharing”, that was submitted for funding (and rejected) in 2014, was removed entirely from the 2015 and 2016 budget requests. Now there is no way to even see the “cost-sharing” portion of the budget at all. And this appears to contract the statement by the DoJ that there is a “mandatory payment” program.

Cost sharing subsidies are an enormous part of Obamacare. “These payments come about because President Obama’s healthcare law forces insurers to limit out-of-pocket costs for certain low income individuals by capping consumer expenses, such as deductibles and co-payments, in insurance policies. In exchange for capping these charges, insurers are supposed to receive compensation.”

Cost sharing is expected to cost taxpayers roughly $150 billion over the next 10 years, according to estimates by the Congressional Budget Office.

But we now don’t know the specific funding amounts for the year 2015 or for 2016, and the costs for 2014 are in dispute, involving that $3 billion in funds from the Treasury (which came from somewhere and somehow).

The one thing we do know for certain: the Treasury Department is clearly exercising the power it perceives to have, as a “rule making authority, as it has on numerous prior occasions, to interpret and to phase in the provisions of a newly enacted tax statute.”