by | ARTICLES, ECONOMY, OBAMA

Gas prices are the highest they’ve ever been so early in the year.

There are plenty of reasons for the high prices, and lots of reasons to expect a big price surge in the spring, said Tom Kloza, chief oil analyst for Oil Price Information Service.

“Early February crude oil prices are higher than they’ve ever been on similar calendar dates through the years, and the price of crude sets the standard for gasoline prices,” Kloza said.

In addition, several refineries have been mothballed in recent months, he said, and some of those refineries “represented the key to a smooth spring transition from winter-to-spring gasoline.” The annual change in gasoline formulas is mandated by pollution-fighting regulations.

However, one overlooked fact regarding the Keystone XL Pipeline is that its rejection by President Obama has directly affected rise of gas prices in recent weeks. Although the pipeline (and ANWR, and other major oil projects) have multi-year lead times, the very fact of a project of this magnitude moving ahead has an immediate effect on the markets by changing the traders’ expectations of future supply. Having more oil available in the marketplace contributes to lower prices for consumers. So when the project was tabled, the markets reacted accordingly.

This administration has once again shown to its hostility toward domestic oil while pandering to the environmentalist electorate. The rejection of such an important project — with the capacity to offer significant work for Americans — only hurts our economy further.

Update: This video today from the WH Press Secretary regarding Keystone is pathological

Update x2: (Feb 29th) Bill Clinton says to “embrace” the Keystone Pipeline

by | ARTICLES, ECONOMY, GOVERNMENT, HYPOCRISY, TAXES

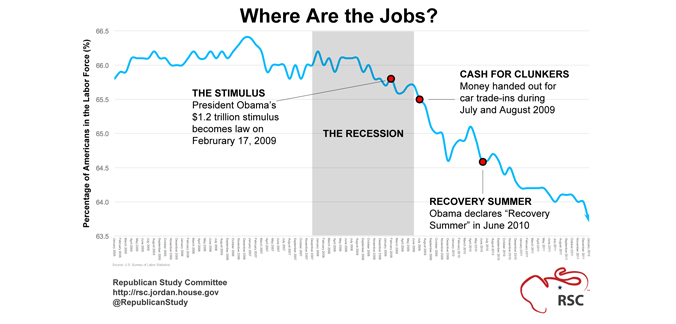

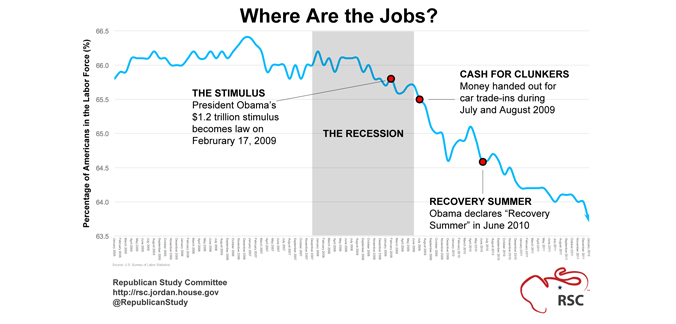

The American Recovery and Reinvestment Act (ARRA) stimulus bill was signed exactly by President Barack Obama on February 17th, 2009. We were told how this would help Americans go back to work while creating more jobs. Yep.

So much for Keynesian Economics.

Daniel Synder did an excellent summary the other day entitled “Economics: The ‘Science’ of Hubristic Hope”. It’s a must read regarding the current state of our economy. Perhaps while we are waiting in line to pump our $5 gas.

by | ARTICLES, CONSTITUTION, HYPOCRISY

Well, isn’t this cozy. The Occupy movement, which began in September, has occupied several universities this spring. USA Today highlights a course being taught at Roosevelt University in Chicago (surprise?) called “Occupy Everywhere”. Similar classes on the history and/or significance of the Occupy cause are being offered at Brown University, USC-San Diego, and New York University. While Columbia could not get approval for such a class in time, it did offer college credit for participation in OWS.

This seems like the perfect opportunity to infiltrate academia just in time for the 2012 election. Don’t forget, the college vote overwhelmingly supported Obama in 2008. There’s even an occupycolleges.org website.

I wonder how many classes are being offered regarding a movement that will celebrate its 3rd birthday in a few days? Sparked by the Rick Santelli “rant” on the floor of the Chicago Mercantile Exchange on February 19, the first Tea Party protests were organized on February 27, 2009. In contrast to the months-long Occupy movement — well noted for filth and crime — the Tea Party significantly impacted the 2010 Congressional elections merely a year later, and has continued to grow as an organized, grassroots group.

The desperation on the Left here is astounding, since most Americans have moved on from the Occupy Movement. At the ivory towers, however, I suppose the closest we could get to a Tea Party class is a course on the Constitution. If they offer one.

Update: Occupy is trying to get more organized. They have filed to form a PAC to help influence the upcoming election cycle

by | ARTICLES, HYPOCRISY, TAXES

While Mitt Romney’s tax rate has been calculated to be around 14%, there are a few unreported factors that account for the small percentage. Additionally, as will be detailed below, Mitt Romney paid taxes on $1 million + in income that does not exist. As a lifelong CPA, I was asked to review it for several media outlets. First, let me say that his return is standard, normal, well prepared, and detailed, with nothing unusual given the scope of his assets. That being said, his tax return is 203 pages. Roughly ½ – ¾ of the pages have nothing to do with tax calculation at all. They relate to the ridiculous and over burdensome compliance of several different natures. These include:

- All foreign owned investment companies

- Details of amounts transferred to foreign investments

- Disclosure of any transaction of anything done that looks like it might be a transaction involving something listed by the IRS as an abusive tax shelter.

For instance, some of his tax shelters involve the use of foreign exchange trading. So, if you have foreign investments with foreign exchange trading, you risk the IRS saying you have characteristics of an abusive tax shelter. His are not; they all fall under broad categories, but in order to safeguard against any appearance of impropriety, he spent the majority of his return providing excessive documentation. However, these pages have nothing to do with his tax rate calculation.

Now, his Adjusted Gross Income (AGI) isn’t exactly as it seems. After you arrive at the AGI, you then subtract your deductions, and then you subtract your exemptions, and then, if you are liable for the AMT you adjust with your add-backs. Then, you have your general income tax rate. However, you are not quite done. One thing in particular with Romney’s return is the foreign tax credit, which is a credit you get for earning income abroad. How it works is that you pay foreign tax on foreign income and then you get a credit on your federal return for having already paid tax on that income. Romney’s credit is $130K. $750K of his income was earned abroad, and so he got credit for the $130K he already paid. This figure was then subtracted from his AGI which makes his AGI look smaller (hence a smaller percentage figure).

Additionally, his AGI was reduced by paying a lot of Massachusetts taxes. State taxes are deducted when calculating taxable income, but then, because of the AMT, some of it was added back. Also, as has been reported, Romney made a large amount of charitable contributions, which further reduced his tax rate. These contributions were made at his discretion – he tithed and then some. His AGI was reduced by that total amount. So, those are the key items that factored into his smaller percentage.

However, the most stunning information on his return is the fact that, due to inequities inherent our tax code, Romney paid taxes on more than a million dollars of income that didn’t exist. How is this possible? When you have hedge fund investments, rather than reporting and paying taxes on profit, the IRS requires you to break it up into component parts. For Romney, those component parts are interest, qualified and non-qualified dividends, short term gains, and long term gains. These are all things that contribute to the positive side of calculation. On the negative side, you have interest and expense. The net of all those you would think he’d pay taxes on, except for one thing.

From the income items, off comes the subtraction for interest. However, all of the other expenses that reduce profit – which, with hedge funds, include virtually all operation expenses to earn income, including fees to the operators – are required to be recorded as miscellaneous itemized deductions. You cannot deduct your share of expenses unless that amount exceeds 2% of your AGI. What’s worse, even if your expenses do exceed the threshold, and you are subject to the AMT you can’t deduct them at all. This inability to deduct necessary expenses incurred while generating that income means that Mitt Romney paid taxes on $1.017 million of income that does not exist.

As I have written on the subject before, regardless of whether a taxpayer is wealthy or not, the fact that the tax code has a floor for deducting the cost of earning income is an injustice that should be amended. You would think that someone would wonder about a tax law that requires a taxpayer to pay taxes on $1 million more of income than he actually earned. But alas, that is not the case.

After being interviewed by three agencies (Bloomberg, NYDaily News, and CBS Evening News), and extensively explaining the nuances with Romney’s AGI and this particular income item, none of the media chose to report it. Curious, I sent this information off to some folks with whom I have worked at Fox Business, but received no reply. I then communicated with a reporter from the Boston Globe, Ms. Beth Healy, who reported erroneous information on this subject in one of her articles, and offered to explain to her the misinformation. After this polite exchange of emails, she never followed up with the phone call she offered to make

. Only choosing to report the general figure of total income tax paid doesn’t effectively tell you the whole story. But perhaps the greater story here — more than the fact that Romney paid taxes on $ 1 million+ worth of income that doesn’t exist — is that five news agencies chose not to discuss how Romney paid “more than his fair share of taxes”. Perhaps doing so would challenge two prevalent narratives 1) hedge funds are bad and 2) the rich should pay more. Update: See how this story relates to the July 3 coordinated media smears on Romney’s finances by the WaPo and Politico

by | ARTICLES, ECONOMY, HYPOCRISY, POLITICS, TAXES

What is so special about April 29, 2009?

It’s the last time Congress passed a budget. 1000 days later, we are operating without any plan. Oh, the delicious irony that it is today… I can’t wait to hear about it during the State of the Union tonight, right? Just like last year’s State of the Union; the budget Obama tried to pass shortly thereafter, modeled on the ideas espoused during his speech, failed 97-0. It was so outrageous, not one Senator of either party would put his name to it.

I’ve read some recent articles about the last 1000 days. Human Events had some worthwhile observations:

Senate Majority Leader Harry Reid (D-NV) said it would be “foolish” to have a budget.

“There’s no need to have a Democratic budget in my opinion,” Reid said in a May interview with the Los Angeles Times. “It would be foolish for us to do a budget at this stage.”

The breakdown in the Senate came after Sen. Kent Conrad (D-ND), chairman of the Budget Committee, failed to get a consensus among panel Democrats last year on any plan that was proposed to the caucus.

Meanwhile, U.S. Rep Sandy Adams penned a short piece about Congressional budget activity, (or lack thereof)

The previous Democrat-led Congress had ample time to do so. With President Obama in theWhite House, Senate Majority Leader Harry Reid and former Speaker Nancy Pelosi had the power to implement any budget they chose. Unfortunately, they punted on their responsibilities, choosing to pass legislation creating a national energy tax and an unpopular health-care law instead.

And finally, the Heritage Foundation put forth their list of facts about our nation’s budget and America’s money:

- The last time the Senate passed a budget was on April 29, 2009.

- Since that date, the federal government has spent $9.4 trillion, adding $4.1 trillion in debt.

- As of January 20, the outstanding public debt stands at $15,240,174,635,409.

- Interest payments on the debt are now more than $200 billion per year.

- President Obama proposed a FY2012 budget last year, and the Senate voted it down 97–0. (And that budget was no prize—according to the Congressional Budget Office, that proposal never had an annual deficit of less than $748 billion, would double the national debt in 10 years and would see annual interest payments approach $1 trillion per year.)

- The Senate rejected House Budget Committee Chairman Paul Ryan’s (R–WI) budget by 57–40 in May 2011, with no Democrats voting for it.

- In FY2011, Washington spent $3.6 trillion. Compare that to the last time the budget was balanced in 2001, when Washington spent $1.8 trillion ($2.1 trillion when you adjust for inflation).

- Entitlement spending will more than double by 2050. That includes spending on Medicare, Medicaid and the Obamacare subsidy program, and Social Security. Total spending on federal health care programs will triple.

- By 2050, the national debt is set to hit 344 percent of Gross Domestic Product.

- Taxes paid per household have risen dramatically, hitting $18,400 in 2010 (compared with $11,295 in 1965). If the 2001 and 2003 tax cuts expire and more middle-class Americans are required to pay the alternative minimum tax (AMT), taxes will reach unprecedented levels.

- Federal spending per household is skyrocketing. Since 1965, spending per household has grown by nearly 162 percent, from $11,431 in 1965 to $29,401 in 2010. From 2010 to 2021, it is projected to rise to $35,773, a 22 percent increase.

So there you have it. We stopped having a budget with a Democrat in the White House, a Democrat-controlled Senate, and with a Democrat-controlled House of Representatives. 1000 days ago. So how come they aren’t talking about it?

Update: The Hill is reporting that some Republicans will be sporting “1000 days” buttons to mark the 1000 days of ineptitude

by | ARTICLES, ECONOMY, FREEDOM, TAXES

The Heritage Foundation just released its 2012 Index of Economic Freedom. The United States is ranked….10.

Top 10 Countries

SEE ALL RANKINGS

For over a decade, The Wall Street Journal and The Heritage Foundation, Washington’s preeminent think tank, have tracked the march of economic freedom around the world with the influential Index of Economic Freedom. Since 1995, the Index has brought Smith’s theories about liberty, prosperity and economic freedom to life by creating 10 benchmarks that gauge the economic success of 184 countries around the world. With its user-friendly format, readers can see how 18th century theories on prosperity and economic freedom are realities in the 21st century.

The Index covers 10 freedoms – from property rights to entrepreneurship – in 184 countries.

So much for the Land of the Free, eh?

by | ARTICLES, GOVERNMENT

It’s another egregious example of the Democrats wanting to overreach boundaries in an effort to appeal to voters:

The Democrats, worried about higher gas prices, want to set up a board that would apply a “windfall profit tax” as high as 100 percent on the sale of oil and gas, according to their legislation. The bill provides no specific guidance for how the board would determine what constitutes a reasonable profit.

The Gas Price Spike Act, H.R. 3784, would apply a windfall tax on the sale of oil and gas that ranges from 50 percent to 100 percent on all surplus earnings exceeding “a reasonable profit.” It would set up a Reasonable Profits Board made up of three presidential nominees that will serve three-year terms. Unlike other bills setting up advisory boards, the Reasonable Profits Board would not be made up of any nominees from Congress.

According to the bill, a windfall tax of 50 percent would be applied when the sale of oil or gas leads to a profit of between 100 percent and 102 percent of a reasonable profit. The windfall tax would jump to 75 percent when the profit is between 102 and 105 percent of a reasonable profit, and above that, the windfall tax would be 100 percent. The bill also specifies that the oil-and-gas companies, as the seller, would have to pay this tax.

Let’s go after the greedy oil companies as a cash cow to fund our politically motivated government projects:

Kucinich said these tax revenues would be used to fund alternative transportation programs when oil-and-gas prices spike

Of course, when the Left hyperventilates over the (seemingly) huge profit numbers of the oil/gas industry, they always choose not to mention the enormous amounts of monies this industry needs to invest just to produce a profit. I’ve written about this concept before when I discussed free will and capitalism.

How delicious is it that our government — unable to even produce a working budget or spend within its limits — is deemed fit to determine what a reasonable profit is.

What happened to free markets in America?

Update: Mr. Ed Morrissey adds to the discussion by explaining to folks, like I stated above, how the oil/gas industry really doesn’t make that much in profits compared to other industry giants

by | ARTICLES, ECONOMY, TAXES

Tom Palmer, a senior fellow at the Cato Institute, penned the following piece over at Policymic. Tom rightly gets to the heart of the matter in his summation at the end of the essay.

“Government debts and printing-press money will harm future generations. It’s unfair. It’s immoral. And it’s going to be solved not by occupying Phoenix, or Wall Street, or Atlanta, but by demanding that spendthrift politicians stop the bailouts and the cronyism, put the brakes on spending, and pay attention to a truly radical concept: arithmetic. Those are sound Tea Party values.”

Should Americans Support the Tea Party or Occupy Wall Street?

by | ARTICLES, GOVERNMENT, OBAMA

“…the current vice president…talks like the sort of guy who sits right next to you on the bus even though there are plenty of empty seats — just so he can explain how squirrels aren’t mammals.”

Indeed, in many respects, he’s as close as American politics gets to a wacky sitcom character who’s a couple fries short of a Happy Meal.

http://www.nationalreview.com/articles/280847/biden-sticks-playbook-jonah-goldberg

by | ARTICLES, ECONOMY, GOVERNMENT, HYPOCRISY, TAXES

I’ve seen very few fact checks pertaining to Obama’s record and/or speeches. USA Today did a nice little round-up of some recent claims by Obama regarding the jobs bill, taxes, etc. I’ve reproduced it below in it’s entirety because it was simple and straightforward.

AP fact check: Obama claims miss some evidence

By Jim Kuhnhenn, The Associated Press

WASHINGTON – In challenging Republicans to get behind his jobs bill Thursday, President Obama argued Republicans have supported his proposals before, demanded that they explain themselves if they oppose him, and challenged others to come up with a plan of their own. The rhetoric in the president’s quick-moving press conference dodged some facts and left some evidence in the dust.

Obama: “If it turns out that there are Republicans who are opposed to this bill, they need to explain to me, but more importantly to their constituencies and the American people, why they’re opposed, and what would they do.”

The facts: While Republicans might not be campaigning on their opposition to Obama’s plan, they’ve hardly kept their objections a secret.

In a memorandum to House Republicans Sept. 16, House Speaker John Boehner and members of the GOPleadership said they could find common ground with Obama on the extension of certain business tax breaks, waiving a payment withholding provision for federal contractors, incentives for hiring veterans, and job training measures in connection with unemployment insurance.

They objected to new spending on public works programs, suggesting instead that Congress and the president work out those priorities in a highway spending bill. And they raised concerns about Obama’s payroll tax cuts for workers and small businesses, arguing that the benefits of a one-year tax cut would be short-lived. The memo also pointed out that reducing payroll taxes, which pay for Social Security, temporarily forces Social Security to tap the government’s general fund. And it opposed additional spending to prevent layoffs of teachers, police officers and other public workers.

Obama: “Every idea that we’ve put forward are ones that traditionally have been supported by Democrats and Republicans alike.”

The facts: Obama proposes to pay for his jobs bill by raising taxes, something traditionally opposed by Republicans and, in the form Obama proposed it, even some Democrats. Senate Democrats were so allergic to Obama’s approach, which relied largely on limiting deductions that can be taken by individuals making over $200,000 a year and couples making more than $250,000, that they’re eliminating it and replacing it with a new tax on millionaires.

In claiming bipartisan support for the components of his proposal, the president appears to be referring just to what the plan would do, not how it’s paid for, but that’s a crucial distinction he doesn’t make.

Some of tax-cutting proposals offered by Obama have received significant Republican support in the past. But some of the new spending he proposes has received only nominal Republican backing. Evidence of bipartisanship provided by the White Houseincludes legislation last year that provided $10 billion to prevent teacher layoffs. It won the support of only two Republican senators —Olympia Snowe and Susan Collins, both of Maine and among the most moderate Republicans in Congress. Another example cited by the White House was proposal last year to offer tax breaks to businesses that hire new workers — it passed the House 217-201 with six Republican votes.

Obama: “The answer we’re getting right now is: Well, we’re going to roll back all these Obama regulations. … Does anybody really think that that is going to create jobs right now and meet the challenges of a global economy?”

The facts: Well, yes, some think it will. The U.S. Chamber of Commerce last month submitted a jobs proposal to Obama that included a call to ease regulations on businesses. It specifically called for streamlining environmental reviews on major construction projects and to delay the issuance of some potentially burdensome regulations until the economy and employment have improved. In the letter, Chamber President Thomas Donohue also called on Congress to pass legislation that would require congressional approval of major regulations. The chamber did not indicate how many jobs such regulatory changes could create, but it said: “Immediate regulatory relief is required in order to begin moving $1 trillion-$2 trillion in accumulated private capital off of the sidelines and into business expansion.”

Obama: “We can either keep taxes exactly as they are for millionaires and billionaires, with loopholes that lead them to have lower tax rates, in some cases, than plumbers and teachers, or we can put teachers and construction workers and veterans back on the job.”

The facts: True, “in some cases” wealthy people can exploit loopholes to make their tax rate lower than for people of middle or low income. In recent rhetoric, Obama had suggested it was commonplace for rich people to pay lower rates than others, a claim not supported by IRS statistics. But on Thursday, Obama accurately stated that it only happens sometimes.

In 2009, 1,470 households filed tax returns with incomes above $1 million yet paid no federal income tax, according to the IRS. Yet that was less than 1 percent of returns with incomes above $1 million. On average, taxpayers who made $1 million or more paid 24.4 percent of their income in federal income taxes; those making $100,000 to $125,000 paid 9.9 percent; those making $50,000 to $60,000 paid 6.3 percent. The White House argues that when payroll taxes — paid only on the first $106,800 of wages — are factored in, more middle class workers wind up with a higher tax rate than millionaires.