by | ARTICLES, GOVERNMENT, TAX TIPS, TAXES

Most people like receiving a tax refund – it’s kind of like a windfall for many people, especially those for whom saving is a difficult discipline. However, getting a big tax refund from the IRS may not necessarily be the best thing for you in certain situations.

Try to think about your refund in a different way. Essentially, you are giving the government an interest-free loan, which they give back to you when you file your taxes. There’s really no reason to do that, other than you like the surprise surplus.

A lot of people don’t like the idea of owing the government, or are afraid they will not have the money available at tax time to pay the bill. That is a valid concern. However, if you adjust your withholding enough so that you owe on April 15th, that also means you have more money in your paycheck each month.

In reality, whether you owe the government or they owe you, the amount of tax collected is virtually the same. The difference is whether you have your taxes paid for you via your paycheck, and have a smaller paycheck because of it (and a refund in the spring), or whether you set the money aside on your own and have a little bit more to take home from work every pay period.

If you set your withholding so that you’ll owe at tax time, you are in essence holding your own money longer. This can be helpful in situations such as being in debt, where payments are due every month. By having extra in your paycheck due to having less money deducted for taxes, you could use the extra money to pay a little more on your debt, thereby reducing the amount of interest you pay in the long run. Some people prefer this approach.

One potential thing to worry about with regard to waiting on federal tax returns. We have seen situations where state governments have delayed issuing refunds in the recent past due to staffing, fiscal woes, and other such problems. Even the federal government last year delayed receiving returns until Jan 31st last year (and therefore remitting refunds) — though that was due to the Fiscal Cliff. However, since the example has been seen in some states, and since the IRS apparently understaffed, it is not an unlikely possible scenario that the federal government might also delay issuing refunds on a larger scale in the future.

At the end of the day, whether you like to keep your own money until tax time or whether you prefer the windfall method, you can achieve this your preference by going to visit your Human Resources administrator. If you want more money in your paycheck – and possibly owing the IRS, claim more dependents. If you prefer a refund, claim fewer dependents. The form to make changes on is called a W-4.

It’s always good practice once a year to review your tax and financial situation and make adjustments as necessary.

______________________

Now What?

Did you like what you read?

If you did, I hope you’ll join my Secret Tax Club.

It’s free, it’s via email, and it’s for you.

I periodically send out information such as tax tips, reading suggestions, articles and more, and the information is not always available anywhere else, even on my own website.

If you want to join, visit my Secret Tax Club page.

Thanks for visiting Tax Politix

by | ARTICLES, BLOG, OBAMACARE, TAX TIPS, TAXES

New Changes to the Itemized Medical Deduction

For years, taxpayers have been able to claim an itemized deduction on their taxes for medical expenses. That deduction still exists, but the threshold has been increased starting this years, as part of the implemenation of Obamacare taxes.

When a taxpayer, spouse, and/or dependents accumulate large medical bills in a given year, the ability to deduct them comes as a welcome relief to many family. The rule-of-thumb was that the sum of medical expenses totalled 7.5% or more of the Adjusted Gross Income (AGI). So for instance, if a family’s AGI was $50,000, they could claim an itemized deduction of medical expenses if it was at least $3,500 (not including insurance premiums, etc).

Now beginning this year and beyond, the threshold has been raised to 10% AGI. That same family making $50,000 AGI needs to have accumulated $5,000 worth of qualifying medical expenses before they can claim that deduction on their tax return.

There is one group for which the floor is still 7.5%; that is persons who are age 65 and above. The 7.5% AGI calculation will remain as such for another 4 years until 2017.

For data through 2009 from the IRS, 10 million families used this tax deduction. Raising the threshold was a means to limit the amount of deductions taxpayers would claim starting this year, thereby raising more tax revenue to pay for Obamacare.

This change is found of found on pages 1,994-1,995 of the PPACA.

——————————-

Now What?

Did you like what you read?

If you did, I hope you’ll join my Secret Tax Club.

It’s free, it’s via email, and it’s for you.

I periodically send out information such as tax tips, reading suggestions, articles and more, and the information is not always available anywhere else, even on my own website.

If you want to join, visit my Secret Tax Club page.

Thanks for visiting Tax Politix

by | ARTICLES, TAX TIPS, TAXES

Most items on this year’s 1040 are the same for last year. However, a few changes should be noted — mainly related to adjustments for inflation.

The new Standard Deduction amounts are as follows:

Single: $6,100

Married Filing Separate: $6,100

Married Filing Joint: $12,200

Head of Household: $8,950

Dependent: the greater value of either 1) earned income plus $350 or 2) $1,000. This cannot exceed $6,100

There are additional Standard Deduction amounts for filers with special status: 1) age 65 and older or 2) blind. These amounts are as follows:

Single or Head of Household: $1,500

Married, Joint: $1,200

Married, Separate: $1,200

Look for Part II on IRS 1040 Changes coming up soon.

_________________________________

Now What?

Did you like what you read?

If you did, I hope you’ll join my Secret Tax Club.

It’s free, it’s via email, and it’s for you.

I periodically send out information such as tax tips, reading suggestions, articles and more, and the information is not always available anywhere else, even on my own website.

If you want to join, visit my Secret Tax Club page.

Thanks for visiting Tax Politix

by | ARTICLES, ECONOMY, FREEDOM, QUICKLY NOTED, TAXES

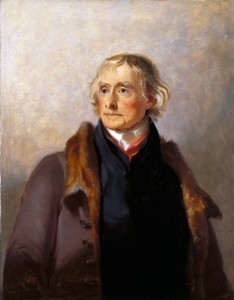

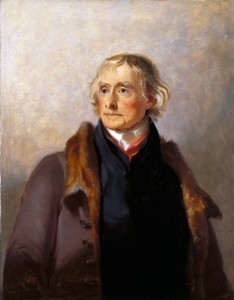

“We must make our election between economy and liberty, or profusion and servitude. If we run into such debts as that we must be taxed in our meat and in our drink, in our necessities and our comforts, in our labors and our amusements,… our people … must come to labor sixteen hours in the twenty-four, give our earnings of fifteen of these to the government,… have no time to think, no means of calling our mis-managers to account; but be glad to obtain sustenance by hiring ourselves out to rivet their chains on the necks of our fellow-sufferers…. And this is the tendency of all human governments … till the bulk of society is reduced to be mere automatons of misery…. And the forehorse of this frightful team is public debt. Taxation follows that, and in its train wretchedness and oppression”.

Thomas Jefferson, 1816

_______________________________

Now What?

Did you like what you read?

If you did, I hope you’ll join my Secret Tax Club.

It’s free, it’s via email, and it’s for you.

I periodically send out information such as tax tips, reading suggestions, articles and more, and the information is not always available anywhere else, even on my own website.

If you want to join, visit my Secret Tax Club page.

Thanks for visiting Tax Politix

by | ARTICLES, BLOG, GOVERNMENT, HYPOCRISY, OBAMA, POLITICS

As we get into blame season surrounding the extension of the debt ceiling, let’s make sure we remember – and remind anyone who will listen — what actually caused the government to shut down just a few short months ago.

The Democrats insisted that the Republicans accept a pure Continuing Resolution (CR) as a first and final offer with no negotiation along the way.

In contrast, the Republicans (after a number of initial offers were rebuffed and ignored with no discussion), made a final offer of 1) simply delaying the individual mandate for one year (which is effectively now happening) and 2) subjecting Congress to ObamaCare as the existing law actually requires anyway.

The Democrats refused even this more than reasonable –and in hindsight quite astute — offer causing the Government to shut down.

In what possible world can the shutdown be blamed directly on the Republicans?!

_______________________________

Now What?

Did you like what you read?

If you did, I hope you’ll join my Secret Tax Club.

It’s free, it’s via email, and it’s for you.

I periodically send out information such as tax tips, reading suggestions, articles and more, and the information is not always available anywhere else, even on my own website.

If you want to join, visit my Secret Tax Club page.

Thanks for visiting Tax Politix

by | ARTICLES, ECONOMY, OBAMA, OBAMACARE

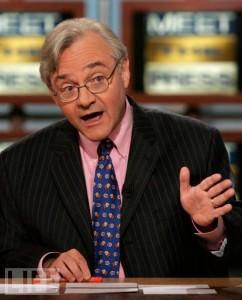

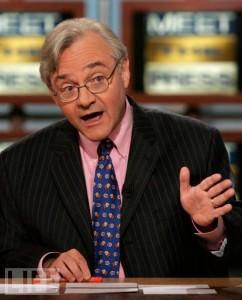

Last week’s Meet the Press roundtable featured, among others, E.J. Dionne — a columnist with the Washington Post. Mr. Dionne’s discussion on Obama and Obamacare was so incredibly inaccurate, it is quite obvious that he is a person who just likes to make up facts as he goes along. And with moderators like David Gregory, who do little to nothing to question the commentary coming from his guests, viewers are left with severely wrong or misinterpreted information.

Some highlights from the show:

>>“Look, I think there is something crazy when people say where government can’t deliver health care. Ever heard of Medicare? Ever heard of Medicaid?”

The fact is that Medicare is actuarially and actually bankrupt, and Medicaid is virtually bankrupting large numbers of states as we speak. Why do people have a positive view of Medicare – simply because they are getting $3 of medical care for each $1 they spend (and hiding from them the fact that the $2 difference will be paid by their children and grandchildren). An SEC investigation would have everyone associated with such a program behind bars. I suppose technically the government does “deliver healthcare” via Medicare and Medicaid but they are so egregiously flawed and mismanaged that it can hardly be considered successful.

> >”President Obama chose to go for a model that is a market-oriented model that Republicans favor, of helping people buy private health insurance”.

A blatant lie. Republicans do favor a market oriented model, but ObamaCare is certainly not anything like one. Can anyone list all the names of the House Republicans who supported and voted for Obamacare in Congress? None? That’s right. In addition, Obamacare is no more a market-oriented model when it renders obsolete millions of plans already freely chosen by Americans and replaces them with fewer and more expensive options — while bullying insurance companies to alter dates and plans according to the whim of any number of government agencies.

>>But what you’re seeing already is there is an enormous appetite among all the Americans who don’t have health insurance to buy it. And that’s what’s going to save Obamacare. This is filling a real need in the society”.

The actual enrollment figures for Obamacare are way off and lower-than-expected. It is so dismal that the White House is counting among the totals for the media the number of people who have “put a plan in their shopping cart” but haven’t paid for it yet in order to bolster totals. Likewise, a lack of “appetite” for Obamacare has resulted in the Obama Administration panicking and paying hundreds of millions of taxpayer money to run commercials and partner with organizations, groups, and non-profits in order to push citizens to sign up before the deadlines (that keep shifting).

>>Every rich democracy in the world uses government to deliver healthcare. You had Christine Lagarde on. France spends less per capita in government spending to cover everybody than we spend for just Medicare and Medicaid. So this thing can work. It needs fixes. And I think the next move by the president is to tell Republicans, do you want to fix this or do you just want to get rid of it?

First of all, the United States is a Republic, not a democracy. Second, the emphasis on the word “rich” is telling because it reeks of the same class warfare-equality policies that have been quintessential to Obama’s presidency. Obamacare is exactly that. It is a wealth transfer that forces the healthy and/or wealthy to subsidize the plans of the uninsured, sicker, or poorer through government fiat — an “individual mandate”. And while Mr. Dionne wishes to hold up France as the pinnacle of Western governing, the French just passed a 75% tax on the wealthy in order to pay for the Socialist policies of Francois Hollande.

E.J.Dionne is representative of the typical progressive pundit who has no framework of reality, and frankly, doesn’t seem to care. He repeats whatever talking points are suitable for the day and the Obama Administration, and its a damn shame that the actual moderators of Meet the Press lack the knowledge or fortitude to call into question their information.

_______________________________

Now What?

Did you like what you read?

If you did, I hope you’ll join my Secret Tax Club.

It’s free, it’s via email, and it’s for you.

I periodically send out information such as tax tips, reading suggestions, articles and more, and the information is not always available anywhere else, even on my own website.

If you want to join, visit my Secret Tax Club page.

Thanks for visiting Tax Politix

by | ARTICLES, ELECTIONS, OBAMA, OBAMACARE, POLITICS

With all the talk abuzz about an inevitable Hillary Clinton candidacy, I wager that her platform might quite likely include repealing Obamacare. Hillary is certain to declare late in the spring so that she can positively impact the midterm elections to benefit the Democrats.

What would Hillary gain from a repeal-Obamacare platform? Here’s three things:

First, a “repeal-Obamacare” position would effectively neuter the Republican narratives of anyone running in 2014 (and possibly beyond). All the hand-wringing and fundraising, all the sob-stories and alarm bells about Obamacare would be utterly weakened if Hillary was out there saying the exact same thing.

Think about it: any Republican candidate on the same policy page as Hillary Clinton would be disastrous for that candidate. The Republicans are hoping for strong gains in 2014 — possibly even taking the Senate — and are banking on a fledgling Obamacare to do it. This objective could not be achieved with Hillary added to the mix arguing that Obamacare is not good legislation.

Second, a “repeal-Obamacare” position from Hillary would give vulnerable Democrats a free pass to sever close ties and loyalty to Obama. Obama is toxic right now; his popularity is in the mid ‘30s and his signature legislation is overwhelmingly disliked across the country. With Hillary jumping in, Democrats would be able to rally around a more popular and likeable Democrat (what Democrat doesn’t like the Clintons?). They could distance themselves from Obama and Obamacare without hurting the Democrat brand for the elections; Hillary enhances that brand right now much better than Obama can.

Finally, Hillary herself was intimately involved in health care reform after Clinton’s election in 1992. The legislation she helped champion via the Taskforce For Health Care Reform was aptly dubbed “Hillarycare”.

Twenty years later — in comparison to what we’ve seen of Obamacare, does Hillarycare looks so bad? Maybe not to some people. Is this the alternative solution and finally Hillary’s day in the sun? Possibly, but not likely.

It is much more plausible that Hillary would take healthcare reform even further than Obamacare. Knowing the growing disdain for mandates and the insurance system that seems helplessly broken right now, Hillary would likely lobby instead for a single-payer system.

This is a dream of many progressives and Democrats. It would be presented as a “simplified” alternative solution to the byzantine problem that is Obamacare, at a time when the Republicans lack their own, strong Obamacare alternative.

Whatever the case, running on repealing Obamacare is a win-win for Hillary. She gets to directly impact and help the midterm elections for the Democrats. 6 years after her primary defeat against Obama, Hillary will emerge as the better, wiser, and more likeable Democrat (revenge is a dish best served cold?). And finally, Hillary will have the unprecedented opportunity to finish the healthcare reform she started two decades ago, since practically anything will be seen as better than Obamacare now.

by | ARTICLES, ECONOMY, QUICKLY NOTED

“To advocate any clear-cut principles of social order is today an almost certain way to incur the stigma of being an unpractical doctrinaire. It has come to be regarded as the sign of the judicious mind that in social matters one does not adhere to fixed principles but decides each question “on its merits”; that one is generally guided by expediency and is ready to compromise between opposed views. Principles, however, have a way of asserting themselves even if they are not explicitly recognized but are only implied in particular decisions, or if they are present only as vague ideas of what is or is not being done. Thus has it come about that under the sign of “neither individualism nor socialism” we are in fact rapidly moving from a society of free individuals toward one of a completely collectivist character.”

This is the beginning of F.A. Hayek’s lecture “Individualism: True and False,” given in 1945. The lecture comprises the first chapter of Hayek’s 1948 work, “Individualism and Economic Order”. Thanks to Mises.org, you can read it online; however, it is a fine book to own for your collection.

_______________________________

Now What?

Did you like what you read?

If you did, I hope you’ll join my Secret Tax Club.

It’s free, it’s via email, and it’s for you.

I periodically send out information such as tax tips, reading suggestions, articles and more, and the information is not always available anywhere else, even on my own website.

If you want to join, visit my Secret Tax Club page.

Thanks for visiting Tax Politix