by | ARTICLES, CONSTITUTION, FREEDOM, GOVERNMENT, OBAMA, POLITICS

As if the recent letter from the Inspectors General to Congress wasn’t enough, there’s a new story about apparent interference from the Feds into an Inspector General report.

The Washington Post reports today about an incident in which an Inspector General for the Commerce department received a “filtered” version that watered down telework abuse incidents in the U.S. Patent Office.

The original report, seen here described “‘fundamental issues’ with the business model of the patent office”, and that oversight was “Oversight of the telework program — and of examiners based at the Alexandria headquarters — was “completely ineffective,”.

The final report was only 16 pages, compared to the original one, which was twice the size.

The report confirmed the fears allayed in the aforementioned letter to Congress: The post reports that “Investigators recommended “unmitigated access” to records when abuse is suspected.

The version supplied to the inspector general, though, explained that managers did not provide full access to computer records that could substantiate allegations of fraud because officials did not want to be seen as “big brother” through electronic surveillance.”

This is in direct violation to the Inspector General Act of 1978, which mandates that each Inspector General is to “have access to all records, reports, audits, reviews, documents, papers, recommendations, or other material available”. And yet, this tactic is growing all-too-common with regard to Inspectors General and their ability to audit the federal government for waste, fraud, and mismanagement.

by | ARTICLES, CONSTITUTION, FREEDOM, GOVERNMENT, HYPOCRISY, OBAMA, POLITICS, TAXES

Inspectors General (yes, that’s the plural) are considered watchdogs for the government. Their jobs primarily focus on “uncovering waste, fraud, and mismanagement”, which is an important function to keep government programs and agencies in check.

A serious breach of trust is evident, therefore, when 47 of 73 Inspectors General pen a letter to Congress describing “serious limitations on access to records.” That’s 64% of the total watchdogs who express such concerns. You can read the letter here:

The letter takes aim at primarily three agencies: the General at the Peace Corps, the Environmental Protection Agency, and the Department of Justice. These Inspectors General “recently faced restrictions on their access to certain records available to their agencies that were needed to perform their oversight work in critical areas.” The restrictions were not limited to just those Inspectors General; hence the overwhelming need to pen a letter to Congress. The Inspectors General described how other

“Inspectors General have, from time to time, faced similar obstacles to their work, whether on a claim that some other law or principle trumped the clear mandate of the IG Act or by the agency’s imposition of unnecessarily burdensome administrative conditions on access. Even when we are ultimately able toresolve these issues with senior agency leadership, the process is often lengthy, delays our work, and diverts time and attention from substantive oversight activities. This plainly is not what Congress intended when it passed the IG Act.

The Inspector General Act of 1978 is clear. The pertinent statute that relates to access is Section §6: Authority of Inspector General; information and assistance from Federal agencies; unreasonable refusal; office space and equipment. It patently states:

(a) In addition to the authority otherwise provided by this Act, each Inspector General, in

carrying out the provisions of this Act, is authorized—

(1) to have access to all records, reports, audits, reviews, documents, papers, recommendations,

or other material available to the applicable establishment which relate to programs and

operations with respect to which that Inspector General has responsibilities under this Act

The full text of the law can be found here:

The letter to Congress was addressed to the Honorable Darrell Issa, the Honorable Thomas R. Carper, The Honorable Elijah Cummings, and The Honorable Tom Coburn. What made the letter particularly notable, however, was its size and scope.

Darrell Issa described, “I’ve never seen a letter like this, and my folks have checked — there has never been a letter even with a dozen IGs complaining. This is the majority of all inspectors general saying not just in the examples they gave, but government wide, they see a pattern that is making them unable to do their job.”

Reading the official website for Inspectors General, one can see they pride themselves on service, “whose primary responsibilities, to the American public, are to detect and prevent fraud, waste, abuse, and violations of law and to promote economy, efficiency and effectiveness in the operations of the Federal Government.”

The fact that the majority of the Inspectors General find themselves unable to perform their duties to audit the federal government is quite troubling, because it is another example of the “most transparent administration” choosing to willfully cloak themselves in secrecy. Stonewalling the very agents — who have a duty to the American people to keep government in check — is another tactical abuse of power.

by | BLOG

USAToday gave a sobering report this week which reaffirmed the inability of our government to be both accurate and transparent.

The Government Accountability Office (GAO) audited spending data from 2012, the most recent year for which data is available, by comparing government agency records with those found on USASpending.gov. The GAO reported that only 2-7% of the numbers found on the website is ‘fully consistent with agencies’ records.” and that at least “$619 billion from 302 federal programs” was missing. You can read the GAO report here.

USASpending.gov states at the top of the website that it is “An Official Web Site of the United States Government”. Moreover, its tagline cheerfully announces, “Government spending at your fingertips”. Except when the data is not accurate.

Some of the key discrepancies include:

“• The Department of Health and Human Services failed to report nearly $544 billion, mostly in direct assistance programs like Medicare. The department admitted that it should have reported aggregate numbers of spending on those programs.

• The Department of the Interior did not report spending for 163 of its 265 assistance programs because, the department said, its accounting systems were not compatible with the data formats required by USASpending.gov. The result: $5.3 billion in spending missing from the website.

• The White House itself failed to report any of the programs it’s directly responsible for. At the Office of National Drug Control Policy, which is part of the White House, officials said they thought HHS was responsible for reporting their spending.

For more than 22% of federal awards, the spending website literally doesn’t know where the money went. The “place of performance” of federal contracts was most likely to be wrong.

Unfortunately, this poor performance of USASpending.gov is not an anomaly. In 2013, the Sunlight Foundation released its “Clearspending” report that also analyzed data from USASpending.gov in 2011:

“The government’s USAspending.gov allows the public to search how it spends money. However, as Clearspending’s findings show, what the federal government posts online about their grants doesn’t always match up with available bookkeeping records (ie. a federal audit). In conducting the Clearspending analysis, Sunlight measured the grant spending on USASpending.gov across three metrics: consistency, completeness, and timeliness. The $1.55 trillion in misreported funds in 2011 account for 94.5 percent of the total grant spending data reported that year. It was an increase from 2010 but lower than that in 2009″ (emphasis added)

2011 was supposed to be a key year for USASpending.gov. Tom Coburn noted that, ““The administration set a goal of 100 percent accuracy by the end of 2011. Three years later the federal government cannot even break a 10 percent accuracy rate.” Coburn was one of the leaders of the transparency website back in 2007 along with then-Senator Barack Obama. It was one of Sen. Obama’s early achievements.

USASpending.gov has been under the authority of the Office of Management and Budget (OMB) since its inception. The GAO reported that the OMB had “ignored repeated warnings from the GAO that reporting standards for executive branch agencies fell short. The OMB said it recognized the errors but never took steps to correct them”.

In May, therefore, Congress passed the DATA Act, which was subsequently signed into law. This takes USASpending.gov from the OMB and hands it over to the Department of the Treasury.

For those expecting the Department of the Treasury to fix the problem of transparency on how the government spends its tax dollars, think again. The Department of the Treasury is the parent agency of the IRS — and we all know how transparent the IRS has been with record-keeping.

by | ARTICLES, FREEDOM

Thomas Sowell is one of the greatest minds of today. His latest essay entitled “Is Thinking Now Obsolete?” is exemplary: I have reposted it in its entirety below:

“Some have said that we are living in a post-industrial era, while others have said that we are living in a post-racial era. But growing evidence suggests that we are living in a post-thinking era.

Many people in Europe and the Western Hemisphere are staging angry protests against Israel’s military action in Gaza. One of the talking points against Israel is that far more Palestinian civilians have been killed by Israeli military attacks than the number of Israeli civilians killed by the Hamas rocket attacks on Israel that started this latest military conflict.

Are these protesters aware that vastly more German civilians were killed by American bombers attacking Nazi Germany during World War II than American civilians killed in the United States by Hitler’s forces?

Talk-show host Geraldo Rivera says that there is no way Israel is winning the battle for world opinion. But Israel is trying to win the battle for survival, while surrounded by enemies. Might that not be more important?

Has any other country, in any other war, been expected to keep the enemy’s civilian casualties no higher than its own civilian casualties? The idea that Israel should do so did not originate among the masses but among the educated intelligentsia.

In an age when scientists are creating artificial intelligence, too many of our educational institutions seem to be creating artificial stupidity.

It is much the same story in our domestic controversies. We have gotten so intimidated by political correctness that our major media outlets dare not call people who immigrate to this country illegally “illegal immigrants.”

Geraldo Rivera has denounced the Drudge Report for carrying news stories that show some of the negative consequences and dangers from allowing vast numbers of youngsters to enter the country illegally and be spread across the country by the Obama administration.

Some of these youngsters are already known to be carrying lice and suffering from disease. Since there have been no thorough medical examinations of most of them, we have no way of knowing whether, or how many, are carrying deadly diseases that will spread to American children when these unexamined young immigrants enter schools across the country.

Are you worried about Ebola breaking out in the U.S.? Sound off in the WND Poll.

The attack against Matt Drudge has been in the classic tradition of demagogues. It turns questions of fact into questions of motive. Geraldo accuses Drudge of trying to start a “civil war.”

Back when masses of immigrants from Europe were entering this country, those with dangerous diseases were turned back from Ellis Island. Nobody thought they had a legal or a moral “right” to be in America or that it was mean or racist not to want our children to catch their diseases.

Even on the less contentious issue of minimum wage laws, there are the same unthinking reactions.

Although liberals are usually gung ho for increasing the minimum wage, there was a sympathetic front-page story in the July 29 San Francisco Chronicle about the plight of a local nonprofit organization that will not be able to serve as many low-income minority youths if it has to pay a higher minimum wage. They are seeking some kind of exemption.

Does it not occur to these people that the very same thing happens when a minimum wage increase applies to profit-based employers? They, too, tend to hire fewer inexperienced young people when there is a minimum wage law.

This is not breaking news. This is what has been happening for generations in the United States and in other countries around the world.

One of the few countries without a minimum wage law is Switzerland, where the unemployment rate has been consistently less than 4 percent for years. Back in 2003, The Economist magazine reported that “Switzerland’s unemployment neared a five-year high of 3.9 percent in February.” The most recent issue shows the Swiss unemployment rate back to a more normal 3.2 percent.

Does anyone think that having minimum wage laws and high youth unemployment is better? In fact, does anyone think at all these days?”

by | ARTICLES, BLOG, BUSINESS, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

When the resident or his advisers talk about inversions these days, they are truly talking about intentional and virulent discrimination of our American companies compared to foreign companies.

In the present environment, U.S. companies are at a severe financial disadvantage compared to foreign companies. Inversions have nothing to do with taxes that the US or foreign companies pay on income they earn within the United States. It all has to do with foreign-earned income, which the United States government lays claim to — and is the only major country to do so. Under U.S. tax law, U.S. companies are forced to pay higher tax rates than other foreign companies on the income they make in foreign countries.

All inversions are, therefore, are a way for U.S. companies to change their HQ from the U.S. to a foreign country, for the sole purpose of allowing themselves the express privilege of being on par with foreign companies and eliminate the severe disadvantage that the U.S. puts on its own businesses!

It is outrageous that the government applies such discrimination. It is outrageous that American companies have to chose to move their headquarters elsewhere simply to survive and compete globally, because they are taxed on their profits in two jurisdictions — both domestic and foreign.

If the government truly abhors the thought of American companies moving their incorporation abroad, then they should drop this tax policy immediately. Make no mistake — every politician who favors this recent, artificial attack on “unpatriotic inversions” shows they are hostile and antagonistic to American companies as well.

For more on what inversions actually are, you can read this earlier article

by | ARTICLES, CONSTITUTION, FREEDOM, GOVERNMENT, OBAMA, POLITICS

The Washington Post reports that a vote to sue President Obama for overreach of powers passed in the House. No Democrats supported the measure as well as 5 Republicans who also voted no.

Here’s where the mess begins. Most Americans are unaware of how the government actually works. Here’s all the nuances pertaining to Congressional and Executive power.

The Legislative branch, Congress, has the power to pass laws.

The Constitution does not grant specific permission for the Executive branch to issue executive orders.

Presidents have used Executive Orders to assist the officers of the Executive Branch (federal agencies) to carry out their duties.

In a court case in 1952, Youngstown Sheet & Tube Co. v. Sawyer, 343 US 579 the Supreme Court ruled that an Executive Order issued by President Truman, which placed all steel mills in the country under federal authority, was “not valid because it attempted to make law, rather than clarify or act to further a law put forth by the Congress or the Constitution”.

And more:

“The Youngstown decision was critical because it established a standard for the exercise of executive power. In his concurring opinion, Justice Robert H. Jackson described three different situations and three corresponding levels of presidential authority:

The president acts with the most authority when he has the “express or implied” consent of Congress

The president has uncertain authority in situations where Congress has not imposed its authority — either by inaction or indifference — and the president takes advantage of this “zone of twilight” to make an executive decision

The president acts with the least authority when he issues an executive order that is “incompatible” with the expressed or implied will of Congress. Such an act, wrote Justice Jackson, threatens the “equilibrium established by our Constitutional system” [source: Contrubis]”

Executive Orders are not meant to create new laws. Nevertheless, Presidents have, in recent years, pushed the envelope in this matter, using “the executive order as an increasingly powerful political weapon, pushing through programs and regulations — often controversial in nature — without Congressional or judicial oversight [source: Savage]. Executive orders can be overruled by the courts or nullified by legislators after the fact, but until then they carry the full weight of federal and state law [source: Contrubis]”

Obama’s response to the lawsuit vote was this:

“They’re going to sue me for taking executive actions to help people. So they’re mad I’m doing my job. And by the way, I’ve told them I’d be happy to do it with you. The only reason I’m doing it on my own is because you’re [Congress] not doing anything,”

One could argue that Obama’s response magnifies the problem. Obama’s job is not to take “executive actions to help people”. His job, per the Constitution, is to “take care that the laws be faithfully executed”. If Congress isn’t doing anything, that doesn’t mean the power to make laws, the Legislative Branch, is abrogated to the Executive Branch.

If Congress does not create and pass a particular law, it is because the people don’t will it. That is a free expression of Congress’s Constitutional power.

When the President says, “I have to act because Congress does not”, it can be argued that he violates the will of the people with a gross overreach of Executive authority.

Legal scholars have weighed in, suggesting that if Congress acts as one body with this lawsuit — in this case, the House passing the measure to sue — they will have decent Congressional standing from a legal perspective. Here’s more on how that works

Because this really has not been done before, it will likely take a long time to settle the matter. Stay tuned.

by | ARTICLES, BLOG, BUSINESS, FREEDOM, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAXES

Reason does a good job (un)covering some clips from 2012, which feature the Chief Architect for Obamacare, Jonathan Gruber. They come at an awkward time just as a Circuit Court judge panel ruled that Obamacare was limited to only providing subsidies in state exchanges, not federal, per the text of the law. The government unsuccessfully argued that everyone meant both federal and state exchanges, and the text was akin to a typo.

Back to the clips and the article. Apparently, in 2012, Jonathan Gruber described precisely the opposite of the government’s recent argument — that Obamacare was limited to state run exchanges and the threat was that, if states did not set up exchanges, the residents of those states would lose out on millions and billions in tax subsidies. Oops.

After being presented with the video, Gruber denied that position and suggested the bill really just contained a typo. And then, a second video was found, also from 2012, which Gruber again argues the same point — that Obamacare only meant to have state-run exchanges. Remember, Gruber was the “chief architect of Obamacare”. Oops again.

The government did not anticipate that a majority of governors would reject the carrot of tax subsidies dangled in front of them when presented implementing Obamacare in their states. They simply did not comprehend that most states would find Obamacare too expensive or too bureaucratic. That is why the bill never said “federal exchanges”. The allure of tons of tax subsides was supposed to woo all the governors to be enticed by this poorly-crafted-bill-that-was-rammed-through-Congress.

When the embarrassment emerged that only a handful of states chose to participate, they scrambled to create federal exchanges, even though that was never intended in the first place. Now the courts have to fight it out. Now we have courts who are split between the language and the spirit of the law.

That is why this unearthing of video footage of the handpicked Obamacare crafter is particularly awkward for the government’s defense.

From the Reason article: (also worthwhile to go there and check out the videos)

“Obamacare’s defenders have responded by saying that this is obviously ridiculous. It doesn’t make any sense in the larger context of the law, and what’s more, no one who supported the law or voted for it ever talked about this. It’s a theory concocted entirely by the law’s opponents, the health law’s backers argue, and never once mentioned by people who crafted or backed the law.

It’s not. One of the law’s architects—at the same time that he was a paid consultant to states deciding whether or not to build their own exchanges—was espousing exactly this interpretation as far back in early 2012, and long before the Halbig suit—the one that was decided this week against the administration—was filed. (A related suit, Pruitt v. Sebelius, had been filed earlier, but did not challenge tax credits within the federal exchanges until an amended version which was filed in late 2012.) It was also several months before the first publication of the paper by Case Western Law Professor Jonathan Adler and Cato Institute Health Policy Director Michael Cannon which detailed the case against the IRS rule.

Jonathan Gruber, a Massachusetts Institute of Technology economist who helped design the Massachusetts health law that was the model for Obamacare, was a key influence on the creation of the federal health law. He was widely quoted in the media. During the crafting of the law, the Obama administration brought him on for consultation because of his expertise. He was paid almost $400,000 to consult with the administration on the law. And he has claimed to have written part of the legislation, the section dealing with small business tax credits.

After the law passed, in 2011 and throughout 2012, multiple states sought his expertise to help them understand their options regarding the choice to set up their own exchanges. During that period of time, in January of 2012, Gruber told an audience at Noblis, a technical management support organization, that tax credits—the subsidies available for health insurance—were only available in states that set up their own exchanges.

A video of the presentation, posted on YouTube, was unearthed tonight by Ryan Radia at the Competitive Enterprise Institute, a libertarian think tank which has participated in the legal challenge to the IRS rule allowing subsidies in federal exchanges. Here’s what Gruber says.

What’s important to remember politically about this is if you’re a state and you don’t set up an exchange, that means your citizens don’t get their tax credits—but your citizens still pay the taxes that support this bill. So you’re essentially saying [to] your citizens you’re going to pay all the taxes to help all the other states in the country. I hope that that’s a blatant enough political reality that states will get their act together and realize there are billions of dollars at stake here in setting up these exchanges. But, you know, once again the politics can get ugly around this. [emphasis added]

There can be no doubt, based on his record, that Gruber is a supporter of the law. He says so in the presentation. “I’m biased, I’m in favor of this type of law, I won’t hide that,” he says. He also explains early on that his entire presentation is made of “verifiable objective facts.”

And what he says is exactly what challengers to the administration’s implementation of the law have been arguing—that if a state chooses not to establish its own exchange, then residents of those states will not be able to access Obamacare’s health insurance tax credits. He says this in response to a question asking whether the federal government will step in if a state chooses not to build its own exchange. Gruber describes the possibility that states won’t enact their own exchanges as one of the potential “threats” to the law. He says this with confidence and certainty, and at no other point in the presentation does he contradict the statement in question.

In early 2013, Gruber told the liberal magazine Mother Jones that the theory advanced by the challengers in this case was “nutty.” Gruber also signed an amicus brief in defense of the administration and the IRS rule. But judging by the video it is quite clear that in 2012 he accepted the essence of the interpretation advanced by the challengers.

Unless this video is a fraud or there are relevant details missing, there are only two options here: Either Gruber, a key influence on the legislation who wrote part of the law and who consulted with multiple states on setting up their own exchanges, was correct, and the law explicitly limits subsidies to state-run exchanges.

Or he was wrong in a way that perfectly aligns with both the clear text of the legislation and the argument later made by the challengers to the IRS rule allowing susbidies in federal exchanges.

Update: Earlier this week, Gruber was on MNSBC to address the Halbig ruling. He was asked if the language limiting subsidies to state-run exchanges was a typo. His response: “It is unambiguous this is a typo. Literally every single person involved in the crafting of this law has said that it’s a typo, that they had no intention of excluding the federal states.”

Update 2: The Cato Institute’s Michael Cannon, who was instrumental in developing the arguments that laid the groundwork for the legal challenge in Halbig, responds to the video at Forbes:

I don’t mean to overstate the importance of this revelation. Gruber acknowledging this feature of the law is not direct evidence of congressional intent. But Gruber is probably the most influential private citizen/government contractor involved in that legislative process. He was in the room with the people who crafted this bill.

Update 3: Gruber says the statement in the video was “a mistake.” Jonathan Cohn of The New Republic got a response from Gruber this morning. Here are a few snippets:

I honestly don’t remember why I said that. I was speaking off-the-cuff. It was just a mistake. People make mistakes. Congress made a mistake drafting the law and I made a mistake talking about it.

During this era, at this time, the federal government was trying to encourage as many states as possible to set up their exchanges. …

At this time, there was also substantial uncertainty about whether the federal backstop would be ready on time for 2014. I might have been thinking that if the federal backstop wasn’t ready by 2014, and states hadn’t set up their own exchange, there was a risk that citizens couldn’t get the tax credits right away. …

But there was never any intention to literally withhold money, to withhold tax credits, from the states that didn’t take that step. That’s clear in the intent of the law and if you talk to anybody who worked on the law. My subsequent statement was just a speak-o—you know, like a typo.

Update 4: Gruber appears to have made a second “speak-o.” In a separate speech, he spoke of the “threat” posed by states declining to build their own exchanges. And he once again explicitly ties the creation of state-based exchanges to the law’s tax credits (its subsidies for private health insurance insurance).

On January 10, 2012, in a speech at the Jewish Community Center of San Francisco, Gruber said that “by not setting up an exchange, the politicians of a state are costing state residents hundreds and millions and billions of dollars….That is really the ultimate threat, is, will people understand that, gee, if your governor doesn’t set up an exchange, you’re losing hundreds of millions of dollars of tax credits to be delivered to your citizens.”

by | ARTICLES, BLOG, BUSINESS, ECONOMY, GOVERNMENT, OBAMA, POLITICS, TAXES

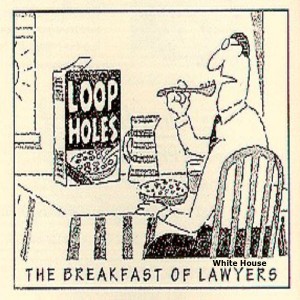

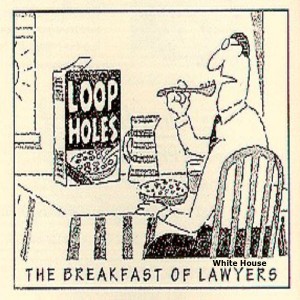

Obama has called “for an end to a corporate loophole that allows companies to avoid federal taxes by shifting their tax domiciles overseas in deals known as ‘inversions’.” Such as statement shows the utter ineptitude that Obama has for understanding a) what inversion actually is and b) how his policies are the cause.

Inversion is not a “corporate loophole” and companies who do so are not “avoiding federal taxes”.

Currently, only the United States taxes American companies on foreign profits as well as domestic. No other major country does this. This policy is non-competitive, stupid, and a major reason why inversion occurs. An American company is being taxed in two jurisdictions.

For instance, if Honda is making cars in the United States, it pays the same taxes as General Motors. But if an American company is in Japan, it has to pay both Japanese taxes and American taxes and therefore has to make an even larger profit just to stay competitive and survive.

If foreign sales grow substantially, a company will find itself paying increased U.S. taxes because it is still incorporated in this country and we tax both foreign and domestic profits. Eventually, a U.S. company may find by moving its incorporation to a different country, it can cease paying U.S. taxes on income that is not generated in the United States — the way every other advanced nation, except for the United States, operates. That extra savings in taxes can be reinvested in the company itself.

Couple this ridiculous tax law with the fact that we also have the highest corporate tax rate in the world as well as a substantial number of stifling regulatory agencies, and it’s small wonder why some companies choose to move abroad eventually.

To call this a “corporate loophole” is exceedingly disingenuous. For some companies to survive, they may have no choice but to move its legal status elsewhere. American companies are in business to make and do things, not to comply with exhaustive tax policy and burdensome bureaucracy. However, the business climate in this country is difficult and to call a company a “deserter” or “unpatriotic” casts the blame squarely in the wrong place — which is a government that over-taxes and over-regulates. That is the problem, and inversion is a symptom of an anti-business environment.

To insinuate that companies who go through the process of inversion are “avoiding federal taxes” entirely omits the reality that this country is the only country who taxes companies both on domestic and foreign profits. Just because we can tax them this way, doesn’t mean we ought to. Reforming the tax code is a better solution.

“Needing to reform inversion” is merely creating another tax grab for Obama — masquerading as fighting against “bad corporations” in order to pander to the rhetoric of the left. The government continues to run chronic deficits and is considering this measure in order to fleece businesses for extra tax revenue. They already face oppressive taxation and burdensome regulation. Attacking them for doing what they might need to do, in order to stay in business, is repugnant.