by | ARTICLES, BLOG, ECONOMY, GOVERNMENT, TAX TIPS, TAXES

Tax season has begun. Normally, the deadline for filing your federal tax return is April 15. But because the Washington D.C. Emancipation Day holiday falls on April 15 this year, Tax Day is the Monday after, April 18th.

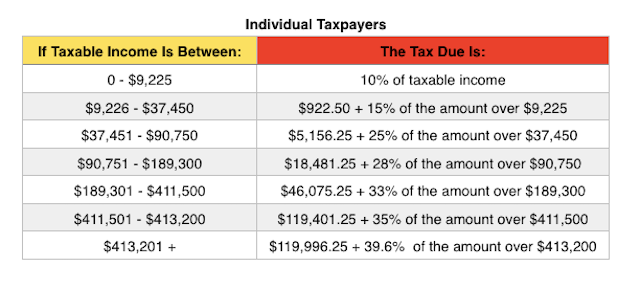

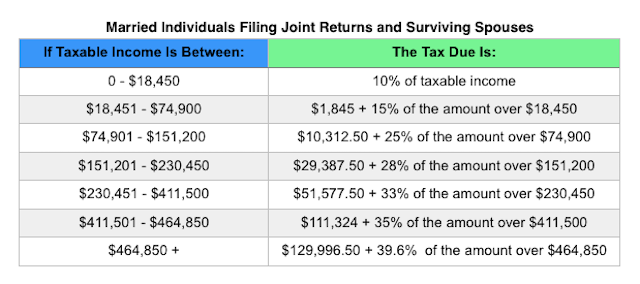

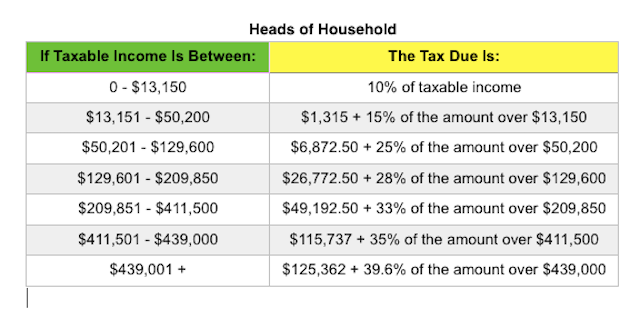

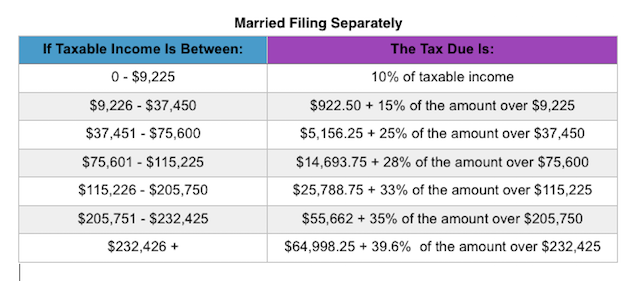

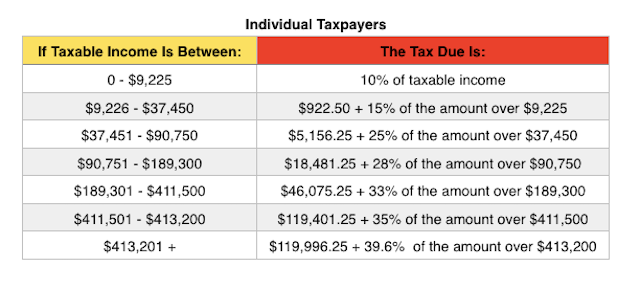

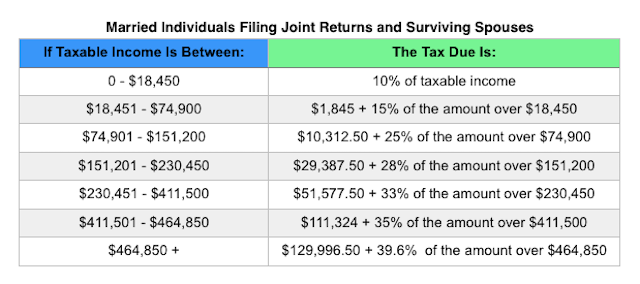

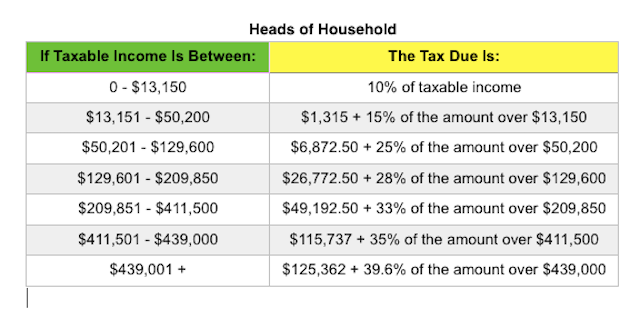

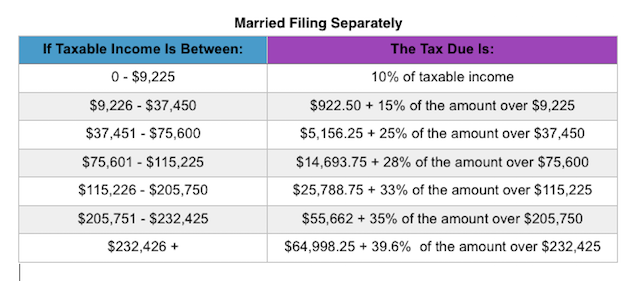

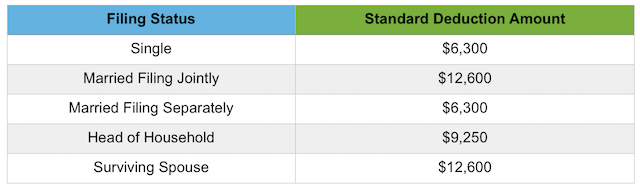

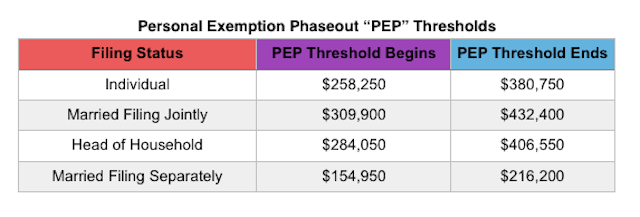

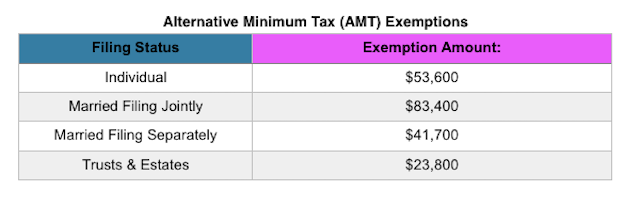

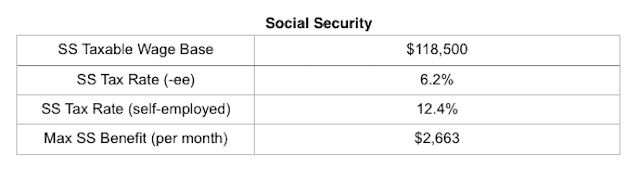

Last spring, Forbes put together a nice, extensive list of all the tax rates and adjustments for 2015. I have posted below some of the most pertinent information. For an all-inclusive list, you should check out the article in its entirety.

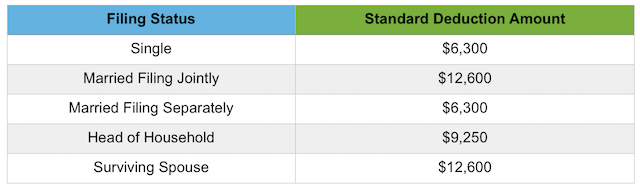

The standard deduction amounts are:

Some tax credits are also adjusted for 2015. Some of the most common tax credits are:

Earned Income Tax Credit (EITC). For 2015, the maximum EITC amount available is $3,359 for taxpayers filing jointly with one child; $5,548 for two children; $6,242 for three or more children (up from $6,143 in 2014) and $503 for no children. Phaseouts are based on filing status and number of children and begin at $8,240 for single taxpayers with no children and $18,110 for single taxpayers with one or more children.

Child & Dependent Care Credit. For 2015, the value used to determine the amount of credit that may be refundable is $3,000 (the credit amount has not changed). Keep in mind that this is the value of the expenses used to determine the credit and not the actual amount of the credit.

Hope Scholarship Credit. The Hope Scholarship Credit for 2015 is an amount equal to 100% of qualified tuition and related expenses not in excess of $2,000 plus 25% of those expenses in excess of $2,000 but not in excess of $4,000. That means that the maximum Hope Scholarship Credit allowable for 2015 is $2,500. Income restrictions do apply and for 2015, those kick in for taxpayers with modified adjusted gross income (MAGI) in excess of $80,000 ($160,000 for a joint return).

Lifetime Learning Credit. As with the Hope Scholarship Credit, income restrictions apply to the Lifetime Learning Credit. For 2015, those restrictions begin with taxpayers with modified adjusted gross income (MAGI) in excess of $55,000 ($110,000 for a joint return).

Changes were also made to certain tax Deductions, deferrals & exclusions for 2015. You’ll find some of the most common here:

Student Loan Interest Deduction. For 2015, the maximum amount that you can take as a deduction for interest paid on student loans remains at $2,500. Phaseouts apply for taxpayers with modified adjusted gross income (MAGI) in excess of $65,000 ($130,000 for joint returns), and is completely phased out for taxpayers with modified adjusted gross income (MAGI) of $80,000 or more ($160,000 or more for joint returns).

Flexible Spending Accounts. The annual dollar limit on employee contributions to employer-sponsored healthcare flexible spending accounts (FSA) edges up to $2,550 for 2015 (up from $2,500).

IRA Contributions. The limit on annual contributions to an Individual Retirement Arrangement (IRA) remains unchanged at $5,500. The additional catch-up contribution limit for individuals aged 50 and over remains at $1,000.

Also note that the floor for medical expenses remains 10% of adjusted gross incocome (AGI) for most taxpayers. Taxpayers over the age of 65 may still use the 7.5% through 2016.

For a more complete list of tables and rates, check out the Forbes article or visit the official IRS website.

by | ARTICLES, BLOG, BUSINESS, ECONOMY, GOVERNMENT, NEW YORK, POLITICS, TAXES

On Wednesday, January 6, Mayor DeBlasio proclaimed a $15/hr minimum wage for the public workers in New York City. The cost for such a plan is expected to be more than $200 million over the next five years. Both De Blasio and Gov. Cuomo seem intent on playing the role of wage-crusader during their respective terms — but only for some New Yorkers.

Just like DeBlasio, Gov. Cuomo announced in early January that “he would provide a $15-an-hour minimum wage to some 28,000 state university workers.” And last November, “the governor made New York the first state to set a $15 minimum wage for public employees; he also took steps to secure $15 an hour for workers at fast-food chain restaurants.” DeBlasio, too, has sought other ways to provide more generous benefits. Late in December, he announced that NYC “would begin offering six weeks of paid parental leave to 20,000 city employees.”

The problem is that these minimum wage hikes not only add to the budget woes, it also creates inequalities between the public and private sector (except for fast-food workers). How is it good for New York that a McDonald’s open next door to a pizza shop with a $5 minimum wage difference? And how can Cuomo attract more businesses to New York state with costs that are already the highest in the entire country — when he is going to make them even higher?

Here in New York City, a minimum wage hike for public workers would mean that New York City will pay more for its labor than it currently has calculated to pay, in order to produce the exact same product or services. Looked at it another way, to then keep to the operating budget, NYC will get less goods and services for the taxes it receives. This would result in a bigger budget deficit — because of having to spend more overall to maintain the current goods and services.

Minimum wage hikes no one anyone except the pockets of the public sector workers, while pushing the budget on an even more unsustainable trajectory. The rest of the taxpayers will be expect to either 1) have yet another tax increase in the near future or 2) see diminished services. Neither of these scenarios benefits New Yorkers.

by | ARTICLES, BLOG, ECONOMY, ELECTIONS, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAXES

After nearly 8 years of listening to Obama talk incessantly about the need for the wealthy to “pay their fair share,” Hillary Clinton has picked up the mantle in her new tax proposal unveiled this week.

Clinton spoke about the need for “an additional 4 percent tax on people making more than $5 million per year, calling the tax a “fair share surcharge.” It is reminiscent of the failed “Buffet Rule” proposal put forth by Obama a few years back.

According to a Clinton staffer, “This surcharge is a direct way to ensure that effective rates rise for taxpayers who are avoiding paying their fair share, and that the richest Americans pay an effective rate higher than middle-class families.”

The tax proposal is calculated to bring in $150 billion on revenue over a ten-year span. Nowhere does it calculate the cost of implementing such a plan, additional paperwork, hours spent on compliance and enforcement, and so forth. As a revenue raiser, it amounts to $15 billion a year for the federal government, pocket change really — something that could be more easily attained by cutting the size and scope of many federal budgets.

It’s not really about revenue anyway. It’s more about pandering to a segment of voters, vilifying the high income earners and stirring up class warfare. It was the one message that resonated most with Obama supporters in 2012; he continuously and intentionally railed against “millionaires and billionaires”, and talked about “the wealthy paying their fair share” in order to create a divide and separate that particular fiscal population from the rest of “mainstream America”. Hillary is merely following the leftist playbook and recycling stale ideas as her candidacy flounders.

by | ARTICLES, BLOG, CONSTITUTION, ELECTIONS, FREEDOM, OBAMA, POLITICS, TAXES

Earlier this week, the Supreme Court heard arguments about the constitutionality of union fees. The case involves an Orange County teacher who has sued to strike down the mandatory fees which pay for both collective bargaining and union activities.

The current law is governed by a 1977 SCOTUS ruling which stated that “public employees can be required to pay a “fair share” fee to reflect the benefits all workers receive from collective bargaining. But at the same time, employees who object cannot be forced to pay for a union’s political activities.” Teachers must pay $650/year for collective bargaining, but can opt out of the nearly $350/year that funds political lobbying and spending by the union — by requesting a refund.

This arrangement is being reexamined, with Justice Kennedy describing ” the mandatory fees as ‘coerced speech’ that violates the 1st Amendment.” The fundamental question, “according to Chief Justice John G. Roberts Jr., is ‘whether or not individuals can be compelled to support political views that they disagree with.'”

A ruling is expected in June. If the mandatory fees are struck down, the unions will undoubtedly face financial difficulty, as it can no longer compel citizens to pay up. How this plays out in a Presidential election year will be even more interesting.

by | ARTICLES, BLOG, BUSINESS, ECONOMY, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAX TIPS, TAXES

Government wage increases vastly outpaced the public sector, and the number of government jobs have soared. For the federal government alone, there are 2.1 million workers, “costing over $260 billion in wages and benefits this year.” according to recent data analysed by the US Bureau of Economic Analysis (BEA).

There is no justification for government workers to earn more than the private sector. What was once a noble profession — the idea of ‘public service’ — has been replaced by as system that allows for and encourages the economic imbalance because the government is not market-driven. Structures such as arbitration and non-firing allow public service employees to continue to receive their benefits and artificial pay raises regardless of the outside economic conditions.

Because of this, public sector wages eventually exceed the normal market-based wages. Negotiations in the public sector should never be “how much of an increase will I receive from before”, but rather, “can we justify these wages and benefits at all?” We should not be paying more than the private sector, which responds and adjusts to the mitigating economic factors; the government does not, and the result is what we see today: sprawling wages, busted pensions, and bloated budgets.

In essence, government workers have stronger job security because they are not dependent on the economy to keep them going. What’s even more sobering is the fact that the private sector marketplace is beginning to lose the best and brightest people, because the government is paying more, and providing employment with better benefits. This will have long-lasting detrimental effects. It was never intended for the government to compete with the private sector. This phenomenon has turned the entire system on its head.

by | ARTICLES, BLOG, BUSINESS, ECONOMY, FREEDOM, GOVERNMENT, OBAMA, OBAMACARE, POLITICS, TAXES

Today, Forbes did an updated analysis of the current state of Obamacare, as the enrollment numbers are trickling in. The news is rather poor:

“To briefly recap this year’s enrollment figures, late sign ups and automatic renewals pushed the number of people signing up for Obamacare through Healthcare.gov to 8.6 million through the end of 2015, before any attrition. Extrapolating from the current numbers implies that total Obamacare sign-ups will reach about 14 million (once the figures from state-run exchanges are baked in). The White House had previously lowered its 2016 goals, hoping to have 10 million people still enrolled and fully paid at the end of 2016 across the federally run healthcare.gov as well as state-run exchanges. The Obama Administration should hit, or slightly top these estimates, once totals from the state exchanges are factored into the final figures.

For comparison, last year, enrollment topped out at 11.5 million. Around 10 million followed through to purchase plans and 9 million ended up with coverage at year-end, after attrition. Applying the same proportions for this year, Wall Street analysts estimate that about 11 million to 12 million consumers will confirm enrollment by paying for their coverage. About 10 million to 11 million will remain enrolled by year-end 2016. This compares to the government’s revised goal of 10 million, (and an older projection from the Congressional Budget Office for 21 million).

Yet the federal numbers show that the rate of growth in the exchanges has declined year over year, and is mostly comprised of people who were previously covered by some kind of Obamacare plan (71% in 2016). Remember that at the end of the 2015 open enrollment period, the total enrollment across both state-based and the federal healthcare.gov marketplace was up 46% from the 2014 open-enrollment period. That was before any attrition. This year, it looks like the year-over-year growth in the exchanges will come in at about half of that figure.

The age mix of those who are signing up also looks to be tracking, at best, on par with prior years and perhaps a little worse. Remember, Obamacare was always dependent upon more young and presumably healthier consumers signing up for the inefficient plans to help subsidize older and costlier beneficiaries. But many young consumers are choosing to forgo the exchange’s high premiums, even as the government’s penalties for remaining uncovered by a “qualified” plan start to rise. For many of the young, and healthy, Obamacare’s overpriced plans are a bad deal.

Data that HHS released yesterday on the federal and state-based exchanges shows that 35% of total federal and state-based selections were by people younger than 35 thus far for 2016. This compares to 33% during the similar time frame during the 2015 open enrollment period and 29% during the 2014 open enrollment period. For health insurers, the slight improvement in the age mix isn’t expected to be material.

Obamacare’s acolytes are casting the tepid growth as success. Under their calculus, any expansion is a measure of progress. This math largely draws from how one charts achievement–whether it’s drawn from considerations of economics, or derived mostly from politics. If the goal is merely expanding Obamacare’s footprint, then each enrollee adds to the political enterprise. But Obamacare was supposed to be affordable, and self-sustaining. It was supposed to replace the individual and small group markets and the health plans people liked, and couldn’t keep.”

The government is willing to do anything to cast Obamacare in a positive light. But nothing can save it from the fact that the enrollment at this point in 2016 will only be half of what was projected when the legislation was voted on in 2010. If anyone thought that Obamacare would only have covered 10 million persons at this point — instead of the 21 million — there is little doubt that it would not have been passed.

Even today, the Obama voted to veto the bill that would have repealed Obamacare (the Restoring Americans’ Healthcare Freedom Reconciliation Act of 2015). Unfortunately for millions of Americans, Obamacare has proven to be yet another bungled, failed, government pipe-dream.

by | ARTICLES, BLOG, BUSINESS, FREEDOM, GOVERNMENT, OBAMA, POLITICS, TAX TIPS, TAXES

My friend, Nina Olson, has been the long-time Taxpayer Advocate (TA) for the IRS, an independent office within the IRS. The job of the TA is to ensure that every taxpayer is treated fairly and that every taxpayer knows and understand his or her rights. Each year, the TA issues two different reports to Congress. Today, the TA released her 2015 Annual Report to Congress, with a list of the twenty most serious problems facing the IRS today.

Think reaching a human at the Internal Revenue Service last tax filing season was tough? Olson anticipates even less telephone and face-to-face customer service in future years. A planned expansion of IRS online offerings will leave taxpayers who seek help the old-fashioned way “up a creek,” listing it as the No. 1 problem in a report to Congress released Wednesday.”

An overview from Bloomberg noted another serious problem: transparency. “Since 2014 the IRS has spent “several million dollars” working with management consultants to develop a plan for how it will operate over the next five years. The details in the report haven’t been made public or shared with Congress, and the IRS hasn’t solicited comments from a broad pool of constituents, the advocate’s report notes.

Additionally, the IRS has never asserted so many times that data and documents the Taxpayer Advocate planned to include were for “official use only” and couldn’t be made public. That made this year’s report difficult to write, Olson says, “because while the intent to reduce telephone and face-to-face service has been a central assumption in the five-year ‘Future State’ planning process, little about service reductions has been committed to writing.”

Olson is calling for congressional hearings on the IRS plan over the next few months, and will solicit comments at public hearings held across the country. Among groups she plans to invite are those with the greatest need for free help, including the elderly, the disabled, small businesses, low-income taxpayers, and people with limited English proficiency.

The impression the Taxpayer Advocate’s office has, based on discussions with IRS officials, is that the agency’s ultimate goal is “to get out of the business of talking with taxpayers.” It would do that in part by creating online accounts for filers, which Olson sees as a good way to supplement, not replace, existing service—as long as data security concerns are addressed.

While far more people file electronically now, and the IRS has taken many steps to limit the need for taxpayers to phone the IRS, the demand for personal service hasn’t decreased. In fact, over the past decade the number of calls the IRS received on its Accounts Management lines rose from about 64 million for fiscal year 2006 to about 102 million for fiscal year 2015. That’s almost a 60 percent jump. Automating customer service even more, the report says, “will mean only those with the means to pay for it can receive help with their taxes.”

Here are Nina’s Top Twenty Problems:

TAXPAYER SERVICE: The IRS Has Developed a Comprehensive “Future State” Plan That Aims to Transform the Way It Interacts With Taxpayers, But Its Plan May Leave Critical Taxpayer Needs and Preferences Unmet

IRS USER FEES: The IRS May Adopt User Fees to Fill Funding Gaps Without Fully Considering Taxpayer Burden and the Impact on Voluntary Compliance

FORM 1023-EZ: Recognition As a Tax-Exempt Organization Is Now Virtually Automatic for Most Applicants, Which Invites Noncompliance, Diverts Tax Dollars and Taxpayer Donations, and Harms Organizations Later Determined to be Taxable

REVENUE PROTECTION: Hundreds of Thousands of Taxpayers File Legitimate Tax Returns That Are Incorrectly Flagged and Experience Substantial Delays in Receiving Their Refunds Because of an Increasing Rate of “False Positives” Within the IRS’s Pre-Refund Wage Verification Program

TAXPAYER ACCESS TO ONLINE ACCOUNT SYSTEM: As the IRS Develops an Online Account System, It May Do Less to Address the Service Needs of Taxpayers Who Wish to Speak with an IRS Employee Due to Preference or Lack of Internet Access or Who Have Issues That Are Not Conducive to Resolution Online

PREPARER ACCESS TO ONLINE ACCOUNTS: Granting Uncredentialed Preparers Access to an Online Taxpayer Account System Could Create Security Risks and Harm Taxpayers

INTERNATIONAL TAXPAYER SERVICE: The IRS’s Strategy for Service on Demand Fails to Compensate for the Closure of International Tax Attaché Offices and Does Not Sufficiently Address the Unique Needs of International Taxpayers

APPEALS: The Appeals Judicial Approach and Culture Project Is Reducing the Quality and Extent of Substantive Administrative Appeals Available to Taxpayers

COLLECTION APPEALS PROGRAM (CAP): The CAP Provides Inadequate Review and Insufficient Protections for Taxpayers Facing Collection Actions

LEVIES ON ASSETS IN RETIREMENT ACCOUNTS: Current IRS Guidance Regarding the Levy of Retirement Accounts Does Not Adequately Protect Taxpayer Rights and Conflicts with Retirement Security Public Policy

NOTICES OF FEDERAL TAX LIEN (NFTL): The IRS Files Most NFTLs Based on Arbitrary Dollar Thresholds Rather Than on a Thorough Analysis of a Taxpayer’s Financial Circumstances and the Impact on Future Compliance and Overall Revenue Collection

THIRD PARTY CONTACTS: IRS Third Party Contact Procedures Do Not Follow the Law and May Unnecessarily Damage Taxpayers’ Businesses and Reputations

WHISTLEBLOWER PROGRAM: The IRS Whistleblower Program Does Not Meet Whistleblowers’ Need for Information During Lengthy Processing Times and Does Not Sufficiently Protect Taxpayers’ Confidential Information From Re-Disclosure by Whistleblowers

AFFORDABLE CARE ACT (ACA) – BUSINESS: The IRS Faces Challenges in Implementing the Employer Provisions of the ACA While Protecting Taxpayer Rights and Minimizing Burden

AFFORDABLE CARE ACT (ACA) – INDIVIDUALS: The IRS Is Compromising Taxpayer Rights As It Continues to Administer the Premium Tax Credit and Individual Shared Responsibility Payment Provisions

IDENTITY THEFT (IDT): The IRS’s Procedures for Assisting Victims of IDT, While Improved, Still Impose Excessive Burden and Delay Refunds for Too Long

AUTOMATED SUBSTITUTE FOR RETURN (ASFR) PROGRAM: Current Selection Criteria for Cases in the ASFR Program Create Rework and Impose Undue Taxpayer Burden

INDIVIDUAL TAXPAYER IDENTIFICATION NUMBERS (ITINs): IRS Processes Create Barriers to Filing and Paying for Taxpayers Who Cannot Obtain Social Security Numbers

PRACTITIONER SERVICES: Reductions in the Practitioner Priority Service Phone Line Staffing and Other Services Burden Practitioners and the IRS

IRS COLLECTION EFFECTIVENESS: The IRS’s Failure to Accurately Input Designated Payment Codes for All Payments Compromises Its Ability to Evaluate Which Actions Are Most Effective in Generating Payments

EXEMPT ORGANIZATIONS (EOs): The IRS’s Delay in Updating Publicly Available Lists of EOs Harms Reinstated Organizations and Misleads Taxpayers

EARNED INCOME TAX CREDIT (EITC): The IRS Does Not Do Enough Taxpayer Education in the Pre-Filing Environment to Improve EITC Compliance and Should Establish a Telephone Helpline Dedicated to Answering Pre-Filing Questions From Low Income Taxpayers About Their EITC Eligibility

EARNED INCOME TAX CREDIT (EITC): The IRS Is Not Adequately Using the EITC Examination Process As an Educational Tool and Is Not Auditing Returns With the Greatest Indirect Potential for Improving EITC Compliance

EARNED INCOME TAX CREDIT (EITC): The IRS’s EITC Return Preparer Strategy Does Not Adequately Address the Role of Preparers in EITC Noncompliance.

You can read the report in full by going here.

by | ARTICLES, BLOG, BUSINESS, ECONOMY, FREEDOM, GOVERNMENT, POLITICS, TAXES

In 2015, the federal government’s published 82,036 pages of rules, proposed rules and notices. It surpassed last year’s 77,687 pages broke the previous record of 81,405 pages in 2010. Competitive Enterprise Institute issued their yearly survey of the federal regulatory state. Among them are some of their findings:

*3,378 final rules and regulations were created

*2,334 proposed rules were issued in 2015 and are at various stages of consideration.

*29 executive orders and 31 executive memorandums were issued

Regulation functions as a hidden tax. Last year’s report calculated that, “based on the best available federal government data, past reports, and contemporary studies, regulatory compliance costs $1.88 trillion annually.”

Recommendations for reigning in regulation include repealing “certain statutes, require congressional approval for big rules and enforce maximum requirements set forth in the Administrative Procedure Act.” 2015 saw major final rules from the EPA — the Clean Power Plan and its Waters of the Unites States rule — as well as the FCC’s net neutrality order.

You can follow updates on federal regulation on CEI’s “Ten Thousand Commandments” page here