by | ARTICLES, FREEDOM, HYPOCRISY, OBAMA, TAXES

A great piece by John Nolte on Tuesday documents the coordinated attack on Romney’s wealth in an attempt to insinuate some sort of financial impropriety.

Nevermind the fact that Romney has unequivocally been squeaky clean in releasing and documenting every bit of his finances.

Nolte goes on to discuss how both the Washington Post and Politico coordinated with Obama’s campaign to hint at potential indiscretions with Romney’s money while covering a pro-Occupy article in Vanity Fair.

Though both Politico and the Post lie through the act of omission by not telling their readers Romney has complied 100% with financial disclosure requirements, what both are doing here (and you can expect the rest of the media to pile on) is laying the foundation for a media-narrative that will demand more disclosure from Romney. The tactic is an old one, for the media knows that the simple act of demanding this kind of information is in and of itself a way of making Romney look slippery and dishonest — you know, like a rich jerk with something to hide — which is exactly how the Obama campaign (and therefore Politico and the Washington Post) intend to define Romney.

Not only is this an attempt to discredit Romney, it is also part of a larger Obama anti-rich campaign narrative. We’ve heard them before: “the rich need to pay their fair share”, “millionaires and billionaires“, “Buffett Rules” and other class-warfare rhetoric. Painting Romney as a rich shyster allows the campaign to continue to push the idea that Obama is one of us…not a big-bad-rich-guy.

Yet, back in January, when Romney disclosed his taxes, the media story then was similar too; Romney paid only about a 15% tax rate — which means (according to their playbook) he didn’t pay enough. Interestingly however, was one aspect of the tax return that went wholly unreported by many news outlets, and not just the overtly liberal ones either (remember in January, Romney was one of several potential GOP candidates). Having reviewed Romney’s returns, I noted that he paid taxes on more than $1 million worth of income that existed on paper only, due to the nature of hedge funds, IRS deduction rules, etc. You can read that report here. Yet no less than five news agencies — liberal and conservative — chose not to cover and discuss a story that had Romney paying “more than his fair share of taxes”. That wouldn’t sell. That didn’t fit the rhetoric. Would have it been different if the returns came out now, now that he is our nominee — and therefore we are more unified against Obama?

Reflecting on that, one thing is certain: we can expect more of these baseless, factless attacks on Romney from the leftist media as the summer marches on. Thankfully, articles like Nolte’s help to expose and dispel the bias and campaign mouthpieces that are indeed active.

by | ARTICLES, OBAMACARE, POLITICS, TAXES

Just to quickly note — a thoughtful piece by Sean Trende offering an interesting take on the Robert’s decision. The article is highly recommended in its entirety. However, here’s just a taste:

The simple fact is that almost all of us pay higher taxes each year than we otherwise would on the basis of things we forgo: whether it is not buying an electric car, not installing energy-efficient windows in our house, or not having that third kid. There’s no new ground being broken here

Robert’s ruling will be dissected for years to come. Looking at it from Trende’s angle is worthwhile.

by | ARTICLES, ECONOMY

Daniel Mitchell had a spot-on piece over at Cato, showcasing the punitive effects of raising income tax rates too high in England. The lower-than-expected revenue receipts have stymied certain politicians and economists — those who don’t understand or believe in the Laffer Curve.

The documented results of higher-tax policy will also be seen in the United States should the Bush tax cuts expire and government spending continue unrestrained. Below is the summary of England’s money debacle:

let’s now take a closer look at David Cameron’s tax increases. They’ve been in place for a while, so we can look at some real-world data. Allister Heath of City AM has the details.

Something very worrying is happening to the UK’s public finances. Income tax and capital gains tax receipts fell by 7.3 per cent in May compared with a year ago, according to official figures. Over the first two months of the fiscal year, they are down by 0.5 per cent. This is merely the confirmation of a hugely important but largely overlooked trend: income and capital gains tax (CGT) receipts were stagnant in 2011-12, edging up by just £414m to £151.7bn, from £151.3bn, a rise of under 0.3 per cent. By contrast, overall tax receipts rose 3.9 per cent.

Is this because the United Kingdom is cutting tax rates? Nope. As we mentioned in the introduction, Cameron is doing just the opposite.

…overall taxes on labour and capital have been hiked: the 50p tax was introduced from April 2010 (and will fall to a still high 45p in April 2013), those earning above £150,000 have lost their personal allowance, CGT has risen to 28 per cent, many workers have been dragged into higher tax thresholds, and so on. In theory, if one were to believe the traditional static model of tax, beloved of establishment economists, this should have meant higher receipts, not lower revenues.

So what’s the problem? Well, it seems that there’s thing called the Laffer Curve.

…there is a revenue-maximising rate of tax – and that if you set rates too high, you raise less because people work less, find ways of avoiding tax or quit the country. The world isn’t static, it is dynamic; people respond to tax rates, just as they respond to other prices. Laffer told a gathering at the Institute of Economic Affairs that this is definitely true in the UK today – and the struggling tax take revealed in the official numbers suggest that he is right. Tax rates and levels are so high as to be counterproductive: slashing capital gains tax would undoubtedly increase its yield, for example. Many self-employed workers are delaying incomes as much as possible until the new, lower top rate of tax kicks in.

Allister’s column also makes the critical point that not all taxes are created equal.

…higher VAT is also damaging growth, though it is still yielding more. Some taxes can still raise more – but try doing that with income tax, CGT or corporation tax and the result is now clearly counter-productive. These taxes are maxed out; they have been pushed beyond their ability to raise revenues.

Last but not least, he makes an essential point about the role of bad spending policy.

The problem is that spending is too high – central government current expenditure is up by 3.7 per cent year on year in April-May – not that taxes are too low. The result is that the April-May budget deficit reached £30.7bn, some £6.2bn higher than a year ago.

While imposing higher taxes on the “wealthy”, “millionaires and billionaires” or “top 2%” makes for good presidential election season rhetoric in the US, England has proven the folly of such policy. Additionally, government spending must be reigned in, not expanded with more “programs”.

Why take additional money from those taxpayers who have been able to create wealth and employment successfully and give it to the government and politicians who have proven their ability to mismanage and squander income?

by | ARTICLES, ECONOMY, GOVERNMENT, TAXES

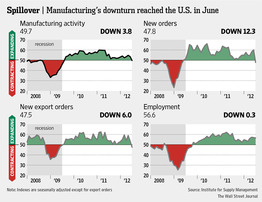

Signaling a slow down in the global economy is affecting U.S. manufacturers, June numbers showed production was down.

The trade group of purchasing managers said its index of manufacturing activity fell to 49.7. That’s down from 53.5 in May. And it’s the lowest reading since July 2009, a month after the Great Recession officially ended. Readings below 50 indicate contraction.

Though growth rates are already sluggish — 1.9% in January-March — the latest manufacturing numbers indicate growth is closer now to a mere annual rate of 1.5%.

Manufacturing Downturn — WSJ July2, 2012

This is not good economic news, which could worsen depending on the unemployment figures due out this week.

by | ARTICLES, BUSINESS, ECONOMY, FREEDOM

The sage Don Boudreaux share the following quote this morning on his website, Cafe Hayek:

“[S]ince profits and losses reflect the success or failure of the entrepreneur in adjusting production to consumer demand, the profits of a competitive (in the Austrian sense) industry can never be “too high” or “too low.”

Followed by his spot on commentary:

Right. To disparage profits earned in competitive markets is to disparage success at arranging for resources to serve consumers well; and to disparage unusually high profits is to disparage success at arranging for resources to serve consumers unusually well.

Put differently, to disparage unusually high profits is to imply that society is harmed whenever entrepreneurs and businesses rescue it from uses of resources that are especially wasteful compared to new, highly profitable uses.

Sadly, though, because such disparagement scores political points with many who are economically unaware – or who embrace envy as a sound justification for public policy – there’s always an abundance of politicians willing to issue such disparagements.

Not much more needs to be said. Boudreaux succinctly captures the essence of free-market enterprise and the benefits of profit to society, the individual, and businesses. To punish success, as our government seeks to do, does irreparable harm to the economy and stifles creativity, investment, growth.

by | ARTICLES, ECONOMY, HYPOCRISY, TAXES

Politico is reporting the quiet release of the White House’s annual salaries report.

Obama is doing his part to grow the economy and add jobs, because the numbers are UP:

A quick review found the White House payroll appears to have grown since last year, going from $37.1 million in 2011 to $37.8 million in 2012. The number of employees listed also grew — from 454 last year to 468 in 2012.

White House officials did not immediately respond to a message seeking explanation of the growth. Overall, the payroll has shrunk since 2009, when it totaled $39.1 million.

You can see the full report here:

The lowest paid positions (3), are $41,000, just slightly below the average median income for the U.S. This excludes (2) positions listed at $0.00, because it is unclear of the nature of the position (intern, etc).

The highest paid positions (20) are $172,200, and are all assistants to the President

There are 139 positions at or above $100,000, out of 466 — which is roughly 29%

There are 3 Calligraphers, who make between $85.9K and $96.7K

There are 2 Ethics Advisors, who make $136K and $140K

Jay Carney is paid $172,200 to lie to the American people as the Press Secretary.

Your tax dollars at work!

by | ARTICLES, OBAMA, OBAMACARE, POLITICS, TAXES

So, the Supreme Court ruled yesterday that ObamaCare is constitutional because it is a tax. That settles it, right?

Not so fast.

On Friday, the day after the ObamaCare ruling, White House Press Secretary Jay Carney insisted the fine is still just a “penalty”.

Carney went on to say Friday that the “penalty” will affect only about 1 percent of Americans, those who refuse to get health insurance. He said the penalty was modeled after the one put in place in Massachusetts when Mitt Romney was governor.

“It’s a penalty, because you have a choice. You don’t have a choice to pay your taxes, right?” Carney said.

Carney was initially reluctant to assign a label to the fine when pressed repeatedly by reporters Friday. “Call it what you want,” he said.

and more:

“You can call it what you want,” he said. “If you read the opinion, it is not a broad-based tax. It affects one percent, by CBO estimates, of the population. It is not something that you assess like an income tax.”

It was unclear which Congressional Budget Office estimate Carney was referring to. Despite being pressed on the issue, though, the spokesman would not relent.

It didn’t even take 24 hours for the games and backtracking by the White House to begin. Don’t forget, they insisted to the American people — in order to get the bill passed — that it was not a tax. Clearly, they are worried about the tax narrative shaping the rest of the election season rhetoric.

by | ARTICLES, CONSTITUTION, HYPOCRISY, OBAMACARE, POLITICS, TAXES

The WSJ editorial this morning, The Roberts Rules, was excellent — as it dissects the inconsistencies within the ObamaCare decision. Read it through, but here are some highlights:

The remarkable decision upholding the Affordable Care Act is shot through with confusion—the mandate that’s really a tax, except when it isn’t, and the government whose powers are limited and enumerated, except when they aren’t.

and this:

The Chief Justice ruled that ObamaCare’s mandate violated the Commerce Clause, joined by the Court’s conservative bloc, but he also said that the mandate fell within Congress’s power to tax, joined by the Court’s liberal bloc. In practice this is a restraint on federal power without real restraint—and, worse, the Chief Justice had to rewrite the statute Congress passed in order to salvage it. The ruling will stand as one of the great what-might-have-beens of American constitutional law.

more:

According to Chief Justice Roberts, the penalty is merely a tax on not owning health insurance, no different from “buying gasoline or earning income,” and it thus complies with the Constitution. This a large loophole.

and this:

But if the mandate is really a tax, why doesn’t the law known as the Anti-Injunction Act apply, which says that taxes can’t be challenged legally until they’ve been collected? The Chief Justice actually rules that the mandate is a tax under the Constitution and a mandate for the purposes of tax law.

Additionally, the WSJ lent some more credence to the assertion that Chief Justice Roberts was actually in agreement with Scalia, Thomas, Kennedy, and Alito (giving a 5-4 strikedown), but at the last minute changed his mind. “One telling note is that the dissent refers repeatedly to “Justice Ginsburg’s dissent” and “the dissent” on the mandate, but of course they should be referring to Ruth Bader Ginsburg’s concurrence. This wording and other sources suggest that there was originally a 5-4 majority striking down at least part of ObamaCare, but then the Chief Justice changed his mind”. This theory was floated yesterday first by Paul Campos and Brad Delong who noticed language confusion and tone changes in the opinion. Their ideas are examined more in depth here.

Now that we have a both a scrutiny of the dissonance and a peek at some silver linings, where do we go from here? It is clear that November must be our top priority — both at the Presidential level and Congress, especially the Senate. And then, we’ll see whether American can be preserved.

Update #1:…and the White House (Jay Carney) is already insisting today that it is NOT A TAX